Professional illustration about Venmo

PayPal Account Setup

Setting up a PayPal account in 2025 is a straightforward process that unlocks access to one of the world’s most versatile digital wallets. Whether you’re looking to shop online, send money to friends, or even manage cryptocurrency, PayPal’s platform integrates seamlessly with millions of merchants, including major retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture. To get started, head to PayPal’s official website or download the mobile app, then follow these steps:

- Choose Your Account Type: PayPal offers personal, business, and premier accounts. A personal account is ideal for everyday transactions, while a business account includes tools for invoicing and payment processing.

- Enter Your Details: Provide basic information like your name, email, and phone number. PayPal’s risk management systems and fraud detection protocols ensure your data remains secure.

- Link a Payment Method: Connect a bank account, PayPal Credit Card, or PayPal Debit Card (issued by Synchrony Bank or The Bancorp Bank) to fund transactions. For added flexibility, you can also link a Mastercard or other major credit cards.

- Verify Your Account: PayPal may require identity verification, such as confirming a small deposit to your bank or uploading a photo ID. This step enhances payment security and unlocks higher transaction limits.

Once your account is active, explore features like PayPal Cashback Mastercard rewards, buy now pay later options, and integrations with Venmo (a subsidiary of PAYPAL INC). For crypto enthusiasts, PayPal’s partnership with Paxos Trust Company allows you to buy, sell, and hold Bitcoin and other cryptocurrencies directly in your wallet.

Pro tip: If you’re a frequent online shopper, enable PayPal’s rewards program to earn cash back on purchases. Dmitry Shevelenko, a fintech expert, highlights how PayPal’s financial technology innovations—like one-touch checkout—streamline the e-commerce experience. Keep in mind that funds in your PayPal balance are eligible for FDIC insurance up to $250,000 when held with partner banks.

For businesses, setting up a PayPal account opens doors to global money transfer capabilities and payment systems that support multiple currencies. Whether you’re a freelancer or a large enterprise, PayPal’s tools simplify invoicing, subscriptions, and even credit approval for eligible users. The platform’s user-friendly interface and robust security make it a top choice for both personal and professional financial services.

To maximize your account’s potential, consider these best practices:

- Enable two-factor authentication for added security.

- Regularly review transaction history to spot any unauthorized activity.

- Link multiple payment methods to avoid disruptions during checkout.

- Explore PayPal’s financial service integrations, such as bill pay and donation features.

By following these steps, you’ll harness the full power of PayPal’s ecosystem, from everyday purchases to advanced financial technology solutions.

Professional illustration about Synchrony

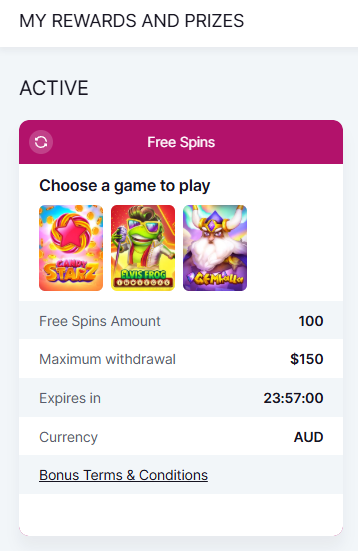

PayPal Fees Explained

Understanding PayPal fees is crucial for both consumers and businesses using this digital wallet for money transfers or payment processing. As of 2025, PayPal's fee structure remains competitive but varies depending on the transaction type, currency, and whether you're sending money domestically or internationally. For personal transactions within the U.S., sending money via PayPal or Venmo using a linked bank account or PayPal balance is free, but using a PayPal Credit Card, PayPal Debit Card, or any other credit/debit card incurs a 2.9% fee plus a fixed $0.30 charge. International transfers can cost up to 5% of the transaction amount, with additional currency conversion fees if applicable.

For businesses, PayPal charges a standard payment processing fee of 3.49% + $0.49 per sale for online transactions, while in-person payments via PayPal Zettle cost 2.29% + $0.09. High-volume merchants may qualify for custom rates, making it essential to negotiate with PAYPAL INC directly. Additionally, buy now pay later services like PayPal Pay in 4 have no interest, but late fees can apply—up to $20 per missed payment.

If you're using PayPal Cashback Mastercard, keep in mind that while it offers cash back rewards (2% on all purchases and 3% when checking out with PayPal), foreign transactions still carry a 3% fee. Similarly, PayPal Credit, issued by Synchrony Bank, provides flexible financing but charges APRs up to 29.99% if balances aren’t paid in full during the promotional period.

For cryptocurrency transactions, Paxos Trust Company facilitates PayPal’s crypto services, charging spread-based fees (typically 1.5%-2%) when buying or selling Bitcoin or Ethereum. Meanwhile, FDIC insurance covers balances held in PayPal Savings (up to $250,000), but this doesn’t apply to funds in your main PayPal account.

To minimize fees, consider these strategies:

- Use PayPal balance or linked bank accounts for personal transfers instead of cards.

- Opt for Mastercard-backed PayPal cards for better rewards programs and lower foreign transaction fees compared to other networks.

- Leverage fraud detection and risk management systems to avoid chargebacks, which can incur additional penalties.

- Check for e-commerce experience perks—some retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture offer exclusive discounts when paying with PayPal.

Industry experts like Dmitry Shevelenko emphasize that while PayPal’s financial technology is robust, users should always review fee disclosures to avoid surprises. Whether you're a freelancer receiving payments or a shopper using payment security features, knowing these details ensures you maximize value while minimizing costs.

Professional illustration about FDIC

PayPal Security Features

PayPal Security Features: Protecting Your Money in 2025

When it comes to payment security, PayPal remains a leader in the financial technology space, offering robust protection for users of its digital wallet, PayPal Credit Card, and PayPal Debit Card. In 2025, the company has doubled down on fraud detection and risk management systems, ensuring that every transaction—whether you're shopping at Abercrombie & Fitch, Adorama, or Ashley Furniture—is secure. One of the standout features is PayPal's Buy Now, Pay Later (BNPL) service, which includes real-time monitoring to prevent unauthorized purchases.

For those using PayPal Cashback Mastercard, the security measures are even more advanced. Partnered with Synchrony Bank and backed by Mastercard's Zero Liability Protection, users are shielded from fraudulent charges. Additionally, funds held in PayPal balances are eligible for FDIC pass-through insurance when stored with partner banks like The Bancorp Bank or Paxos Trust Company, adding an extra layer of safety.

Here’s how PayPal keeps your money transfer and e-commerce experience secure in 2025:

- Encryption & Tokenization: Every transaction is encrypted, and sensitive data is replaced with tokens, making it useless to hackers.

- 24/7 Fraud Monitoring: PayPal’s AI-driven systems scan for suspicious activity, flagging irregularities like unexpected large purchases or rapid payment processing attempts.

- Two-Factor Authentication (2FA): An extra step for logging in or approving high-risk transactions, reducing the chance of unauthorized access.

- Purchase Protection: Eligible purchases are covered if they don’t arrive or match the seller’s description, a perk that extends to Venmo users as well.

For cryptocurrency enthusiasts, PayPal’s integration with Paxos Trust Company ensures secure trading and storage of digital assets. Dmitry Shevelenko, a fintech expert, has praised PayPal’s adaptive security measures, which evolve alongside emerging threats. Whether you’re earning cash back through the rewards program or splitting bills with friends, PayPal’s payment systems are designed to keep your financial data safe without compromising convenience.

Finally, PayPal’s credit approval process includes rigorous identity verification, reducing the risk of fraudulent accounts. With these layers of protection, users can confidently manage their financial services knowing PayPal prioritizes security as much as seamless transactions.

Professional illustration about Furniture

PayPal for Businesses

PayPal for Businesses

In 2025, PayPal remains a powerhouse for businesses of all sizes, offering a suite of financial services tailored to streamline payment processing, enhance payment security, and boost sales. Whether you're a small e-commerce store or a large enterprise, integrating PayPal can significantly improve your e-commerce experience. One of the standout features is PayPal's Buy Now, Pay Later (BNPL) option, which allows customers to split purchases into interest-free installments—a game-changer for merchants like Abercrombie & Fitch and Ashley Furniture, who’ve reported higher conversion rates since adopting the service.

For businesses looking to offer flexible payment options, PayPal Credit Card and PayPal Debit Card (issued by Synchrony Bank and The Bancorp Bank, respectively) provide customers with seamless checkout experiences. The PayPal Cashback Mastercard is another attractive tool, offering cash back rewards that incentivize repeat purchases. These cards are backed by Mastercard’s global network, ensuring wide acceptance and robust fraud detection systems.

Security is a top priority for PayPal, with advanced risk management systems and FDIC-insured balances through partner banks like Paxos Trust Company. This level of protection is crucial for businesses handling high-volume transactions, as it minimizes chargebacks and fraudulent activities. Additionally, PayPal’s digital wallet integration with Venmo (a subsidiary of PAYPAL INC) opens doors to younger demographics who prefer peer-to-peer payment apps.

For merchants, PayPal’s payment systems are designed to integrate effortlessly with major e-commerce platforms. Companies like Adorama have leveraged PayPal’s rewards program to encourage customer loyalty, while tools like PayPal’s cryptocurrency support cater to tech-savvy shoppers. Dmitry Shevelenko, a fintech expert, highlights how PayPal’s financial technology adapts to market trends, ensuring businesses stay competitive.

Here’s how businesses can maximize PayPal’s offerings in 2025:

- Optimize checkout flows by enabling one-tap payments through PayPal’s digital wallet.

- Promote BNPL options at checkout to reduce cart abandonment.

- Leverage the PayPal Cashback Mastercard to attract budget-conscious shoppers.

- Use PayPal’s analytics to track customer spending patterns and tailor promotions.

With its evolving money transfer capabilities and merchant-focused tools, PayPal continues to be a vital partner for businesses aiming to scale in the digital economy.

Professional illustration about Shevelenko

PayPal Mobile App Guide

The PayPal Mobile App is your all-in-one digital wallet solution, offering seamless payment processing, secure money transfers, and exclusive rewards programs—all from the palm of your hand. Whether you're splitting bills with friends via Venmo (a PayPal-owned service), shopping at Abercrombie & Fitch or Adorama, or managing your PayPal Cashback Mastercard, the app streamlines every financial move. With over 435 million active accounts globally, PAYPAL INC has refined its mobile experience to prioritize speed, payment security, and e-commerce experience—making it a must-have for 2025’s tech-savvy consumers.

Key Features You’ll Love

- Buy Now, Pay Later (BNPL): Split purchases into interest-free installments directly in the app—no need for separate credit approval.

- Cryptocurrency Integration: Partnering with Paxos Trust Company, PayPal lets you buy, sell, and hold Bitcoin and Ethereum with real-time tracking.

- Fraud Detection: Advanced risk management systems flag suspicious activity, and funds are FDIC-insured through partner banks like Synchrony Bank and The Bancorp Bank.

Pro Tips for Power Users

- Maximize Cash Back: Activate the PayPal Cashback Mastercard in-app to earn 3% back on PayPal purchases and 2% everywhere Mastercard is accepted. Stack this with retailer-specific deals (e.g., 5% back at Adorama through PayPal’s rewards hub).

- Peer-to-Peer (P2P) Payments: Send money to contacts instantly using just their email or phone number—ideal for reimbursing friends or paying freelancers.

- Budgeting Tools: Use the app’s spending analytics to track trends. For example, Dmitry Shevelenko, a fintech expert, highlights how visualizing cash flow can curb overspending.

Security First

PayPal’s app employs military-grade encryption and two-factor authentication (2FA). If your phone is lost, remotely log out of all devices via the website—a lifesaver in 2025’s rising financial technology threat landscape. For added safety, enable biometric logins (Face ID or fingerprint) and regularly review linked devices under "Security Settings."

Behind the Scenes: How It Works

When you pay via the app, PayPal acts as a buffer—your card/bank details are never shared with merchants. This layer of abstraction reduces exposure to data breaches. For payment systems geeks: Transactions route through PayPal’s proprietary network, which settles faster than traditional ACH transfers.

The Bottom Line

From cryptocurrency trading to buy now pay later flexibility, the PayPal app is more than a financial service—it’s a command center for modern money management. Whether you’re a casual shopper or a power user leveraging every cash back opportunity, the 2025 update makes it easier than ever to stay in control.

PayPal International Transfers

PayPal International Transfers offer a seamless way to send and receive money across borders, making it a top choice for freelancers, businesses, and travelers in 2025. With over 400 million active accounts worldwide, PayPal’s payment processing system is designed for speed and security, supporting transactions in 25 currencies with competitive exchange rates. Whether you’re paying an overseas freelancer or splitting bills with friends abroad, PayPal’s digital wallet integrates with Venmo for peer-to-peer transfers, while its partnership with Mastercard ensures broad acceptance. For larger transactions, PayPal Credit Card and PayPal Debit Card users enjoy added perks like cash back and fraud detection features backed by Synchrony Bank and The Bancorp Bank.

One standout feature is PayPal’s buy now pay later option, which lets users split international purchases into installments—ideal for big-ticket items from retailers like Ashley Furniture or Adorama. The platform also supports cryptocurrency transfers through Paxos Trust Company, though fees vary by region. For businesses, PayPal’s risk management systems minimize chargebacks, while its rewards program incentivizes frequent use. Dmitry Shevelenko, a fintech expert, highlights how PayPal’s financial technology streamlines cross-border commerce, especially for SMEs navigating e-commerce experience challenges.

Here’s how to optimize international transfers:

- Check fees upfront: PayPal charges a percentage (up to 5%) plus a fixed fee for currency conversion. Sending USD to another USD account? Avoid conversion fees by selecting “Send in recipient’s currency.”

- Leverage FDIC-insured accounts: Funds held in PayPal’s digital wallet are safeguarded up to $250,000 through partner banks.

- Use PayPal Cashback Mastercard: Earn 2-3% back on eligible international purchases, including Abercrombie & Fitch orders.

- Monitor exchange rates: PayPal’s rates are often less favorable than banks’. For large sums, compare with alternatives like Wise or Revolut.

Security is a priority: PayPal’s payment security includes two-factor authentication and AI-driven fraud detection. However, always confirm the recipient’s details—transfers can’t be canceled once completed. For recurring payments, set up automatic withdrawals to avoid manual fees. Small businesses should explore PayPal’s financial services, like invoicing tools with multi-currency support, to simplify global operations.

Pro tip: If you’re a freelancer, link your PayPal Credit Card to platforms like Upwork for instant access to earnings. The card’s credit approval process is swift, and the rewards program stacks with partner offers. Just remember: While PayPal excels in convenience, it’s not always the cheapest for high-volume transfers. Weigh the trade-offs between speed, cost, and features based on your needs.

PayPal Buyer Protection

PayPal Buyer Protection is one of the most robust safeguards in the digital wallet space, ensuring shoppers can transact with confidence across millions of online stores. As a financial service leader, PAYPAL INC backs eligible purchases with coverage for items that never arrive, are significantly different from the seller’s description, or are unauthorized transactions. For example, if you buy a limited-edition sneaker through Adorama but receive a counterfeit pair, PayPal’s fraud detection and risk management systems can step in to refund your purchase—up to $20,000 per claim in 2025. This program is especially valuable for high-ticket purchases, like furniture from Ashley Furniture, where disputes over quality or delivery delays are more common.

What sets PayPal apart is its seamless integration with other services like Venmo and the PayPal Credit Card, which extends similar protections. Even when using buy now pay later options or the PayPal Cashback Mastercard (issued by Synchrony Bank), users benefit from the same dispute resolution process. For instance, Dmitry Shevelenko, a fintech expert, highlights how PayPal’s payment security measures—like encryption and 24/7 transaction monitoring—complement its Buyer Protection to reduce chargebacks. Notably, the policy doesn’t cover intangible items (e.g., digital downloads) or purchases made through peer-to-peer transfers, so always check eligibility before filing a claim.

Here’s how to maximize PayPal Buyer Protection:

- Document everything: Save order confirmations, photos of damaged items, and correspondence with sellers.

- Act fast: Disputes must be opened within 180 days of purchase, but escalating to a claim within 20 days speeds up resolution.

- Leverage linked cards: Even if you pay via Mastercard or a PayPal Debit Card (backed by The Bancorp Bank), the protection still applies—just ensure the transaction goes through PayPal’s payment processing system.

For cryptocurrency purchases, note that Paxos Trust Company handles PayPal’s crypto services, but these transactions aren’t covered under Buyer Protection. However, traditional e-commerce experience purchases—like a new wardrobe from Abercrombie & Fitch—are fully eligible. The program also ties into PayPal’s rewards program; cardholders earning cash back can still file claims without losing their bonuses.

Pro tip: If a seller disputes your claim, PayPal’s mediation team reviews evidence from both sides. Providing screenshots of product listings or bank statements (for money transfer discrepancies) strengthens your case. While FDIC insurance doesn’t apply to Buyer Protection (it’s not a deposit account), PayPal’s escrow-like system ensures fairness in resolutions. Whether you’re a frequent online shopper or a small business owner, understanding these nuances helps you navigate financial technology tools with fewer headaches.

PayPal Seller Tools

PayPal Seller Tools offer a robust suite of features designed to streamline payment processing, enhance security, and boost sales for businesses of all sizes. Whether you're a small e-commerce store or a large retailer like Abercrombie & Fitch or Ashley Furniture, PayPal’s tools integrate seamlessly with your existing systems to create a frictionless e-commerce experience. One standout feature is PayPal’s payment processing, which supports multiple payment methods, including digital wallet transactions via Venmo (owned by PAYPAL INC), credit cards like the PayPal Cashback Mastercard, and even cryptocurrency through partnerships with Paxos Trust Company. This flexibility ensures customers can pay how they prefer, reducing cart abandonment rates.

For sellers concerned about payment security, PayPal’s advanced fraud detection and risk management systems leverage AI to flag suspicious transactions in real-time. This is particularly valuable for high-risk industries or businesses processing large volumes of payments. Additionally, PayPal’s buy now pay later option (powered by Synchrony Bank) can increase average order values by allowing customers to split purchases into interest-free installments—a feature that’s proven popular with brands like Adorama.

Another game-changer is PayPal’s rewards program, which incentivizes repeat purchases. For example, sellers can offer cashback promotions tied to the PayPal Credit Card or PayPal Debit Card (issued by The Bancorp Bank and backed by Mastercard). These cards not only drive customer loyalty but also come with FDIC-insured protection, adding an extra layer of trust. Dmitry Shevelenko, a fintech expert, has highlighted how such integrations can "bridge the gap between convenience and financial service innovation."

Here’s a quick breakdown of key tools sellers should leverage:

- PayPal Checkout: A one-click solution that speeds up transactions by storing customer details securely.

- PayPal Invoicing: Customizable invoices with automated reminders to reduce late payments.

- PayPal Business Debit Card: Instant access to funds with 1% cashback on eligible purchases.

- PayPal Working Capital: A financing option based on sales history, ideal for scaling operations.

For sellers navigating global markets, PayPal’s money transfer capabilities support 25+ currencies, eliminating the hassle of manual conversions. Plus, with financial technology constantly evolving, PayPal regularly updates its seller tools—like its 2025 rollout of enhanced payment systems with lower fees for high-volume merchants. Whether you’re optimizing for credit approval rates or looking to integrate cryptocurrency payments, PayPal’s ecosystem is built to adapt. The key is to test these tools incrementally; for instance, A/B testing buy now pay later promotions can reveal which strategies resonate most with your audience.

PayPal Credit Options

PayPal Credit Options offer flexible ways to manage your finances, whether you're shopping online or in-store. As one of the leading digital wallet providers, PAYPAL INC has partnered with Synchrony Bank and The Bancorp Bank to deliver a range of credit solutions, including the PayPal Credit Card, PayPal Cashback Mastercard, and PayPal Debit Card. These options cater to different spending habits, from earning cash back rewards to leveraging buy now pay later plans.

For shoppers looking for a seamless e-commerce experience, the PayPal Credit Card stands out with its rewards program, offering 3% cash back on PayPal purchases and 2% on all other transactions. Partnered with Mastercard, this card is accepted globally, making it ideal for frequent online shoppers. Meanwhile, the PayPal Cashback Mastercard is perfect for those who prefer flat-rate rewards, providing 2% cash back on all purchases—no category restrictions. Both cards come with robust payment security features, including fraud detection and risk management systems, ensuring your transactions are safe.

If you prefer a debit option, the PayPal Debit Card links directly to your PayPal balance or bank account, allowing you to spend without accruing debt. It also supports cryptocurrency transactions through Paxos Trust Company, giving users the flexibility to convert crypto to USD for purchases. Plus, funds are FDIC-insured up to the legal limit, adding an extra layer of security.

For those who love installment plans, PayPal’s buy now pay later feature (available through Venmo as well) lets you split purchases into four interest-free payments at retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture. This option doesn’t require a hard credit approval check, making it accessible even if you’re building credit.

Industry experts like Dmitry Shevelenko have highlighted how PayPal’s financial technology innovations are reshaping payment systems, particularly with integrated money transfer capabilities. Whether you need a credit line, cash-back perks, or a simple debit solution, PayPal’s credit options are designed to enhance your financial service experience while keeping security at the forefront.

PayPal Debit Card Benefits

The PayPal Debit Card is one of the most versatile financial tools in 2025, seamlessly bridging the gap between your digital wallet and everyday spending. Issued by The Bancorp Bank or Synchrony Bank (depending on the card type), it’s linked directly to your PayPal balance, eliminating the need to transfer funds to a traditional bank account for purchases. With Mastercard’s global acceptance, you can use it anywhere—online, in-store, or at ATMs—making it a must-have for those who prioritize convenience. One standout feature is the 2% cash back on PayPal purchases, a perk that rivals many PayPal Credit Card or PayPal Cashback Mastercard offers, but without the credit check or approval process.

For frequent shoppers, the card’s integration with PayPal’s rewards program unlocks exclusive deals at partners like Abercrombie & Fitch, Adorama, and Ashley Furniture. Imagine earning cash back while furnishing your home or upgrading your tech gear—all without juggling multiple loyalty programs. The card also supports buy now pay later options through PayPal’s Pay in 4 feature, splitting eligible purchases into interest-free installments. Dmitry Shevelenko, a fintech expert, highlights how such flexibility is reshaping the e-commerce experience, especially for budget-conscious consumers.

Security is another major win. The card leverages PayPal’s fraud detection and risk management systems, which monitor transactions in real-time. Unlike traditional debit cards, it doesn’t expose your bank details during checkout, adding an extra layer of payment security. Funds are FDIC-insured up to $250,000 when held in PayPal’s partnered banks, so your money stays protected. Plus, if you’re into cryptocurrency, the card works seamlessly with Paxos Trust Company-backed crypto transfers, letting you spend Bitcoin or Ethereum like cash (where supported).

Here’s a pro tip: Pair your PayPal Debit Card with the app’s money transfer features to send or request funds instantly. Whether splitting bills or paying freelancers, it’s faster than Venmo for cross-border transactions, thanks to PayPal’s robust payment processing network. And since it’s a prepaid tool, you avoid overdraft fees—just load what you need. For small-business owners, this means better cash flow control without the hassle of a business credit line.

In short, the PayPal Debit Card isn’t just a spending tool; it’s a gateway to smarter financial technology. From cash back rewards to crypto compatibility, it’s designed for the modern spender who values flexibility, security, and rewards—all in one sleek piece of plastic.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support has evolved significantly in 2025, solidifying its position as a leader in bridging traditional payment systems with the fast-growing financial technology of digital assets. Since its initial rollout, PayPal has expanded its cryptocurrency offerings to include not just buying and selling but also seamless integration with its digital wallet, Venmo, and even its PayPal Cashback Mastercard. This move has made it easier than ever for users to diversify their portfolios without leaving the PayPal ecosystem.

One of the standout features is the ability to use crypto for everyday purchases. For example, when shopping at partners like Abercrombie & Fitch, Adorama, or Ashley Furniture, customers can now opt to pay with Bitcoin, Ethereum, or other supported cryptocurrencies—automatically converted to fiat at checkout. This eliminates the volatility concerns typically associated with crypto transactions while still leveraging its benefits. Behind the scenes, Paxos Trust Company handles the custody and compliance, ensuring payment security and regulatory adherence.

For those who prefer earning rewards, the PayPal Credit Card and PayPal Debit Card (issued by Synchrony Bank and The Bancorp Bank, respectively) offer unique cash back opportunities when linked to crypto holdings. Users can earn additional rewards by converting crypto into PayPal’s stablecoin or using it to fund their buy now pay later transactions. The rewards program is designed to incentivize crypto adoption while maintaining the simplicity of PayPal’s e-commerce experience.

Security remains a top priority, with PayPal leveraging advanced fraud detection and risk management systems to protect users. All crypto transactions are FDIC-insured up to certain limits, providing peace of mind. Dmitry Shevelenko, a key figure in PayPal’s crypto strategy, has emphasized the company’s commitment to making digital assets accessible without compromising on safety.

Here’s how you can maximize PayPal’s crypto features in 2025:

- Use crypto for everyday spending: Take advantage of instant conversion at checkout to avoid price fluctuations.

- Combine crypto with rewards: Link your PayPal Credit Card to earn extra cash back on crypto-funded purchases.

- Diversify holdings: PayPal now supports staking for select cryptocurrencies, allowing users to grow their assets passively.

- Stay informed: Regularly check PayPal’s updates for new supported coins or merchant partnerships.

With Mastercard’s expanding crypto infrastructure and PayPal’s user-friendly approach, the platform is a compelling choice for both beginners and seasoned crypto enthusiasts. Whether you’re looking to invest, spend, or simply explore digital currencies, PayPal’s integrated tools and financial services make it a one-stop solution. The future of money transfer and payments is here, and PayPal is at the forefront.

PayPal Dispute Resolution

PayPal Dispute Resolution is a critical feature for users who rely on PayPal’s digital wallet and payment processing services for secure transactions. Whether you’re using PayPal Credit Card, PayPal Debit Card, or even Venmo, disputes can arise from unauthorized charges, undelivered goods, or merchant disagreements. In 2025, PayPal has refined its fraud detection and risk management systems to streamline the resolution process, ensuring users can confidently shop online or send money.

One of the standout aspects of PayPal’s dispute system is its tiered approach. For minor issues, like a missing item or incorrect billing, users can directly contact the seller through PayPal’s Messaging Center—a feature integrated into the e-commerce experience. If unresolved, escalating to a formal dispute triggers PayPal’s mediation team, which reviews transaction details, communication logs, and supporting evidence (e.g., tracking numbers or receipts). Notably, PayPal Cashback Mastercard holders enjoy additional protections, as these transactions fall under Mastercard’s zero-liability policy, adding an extra layer of payment security.

For high-stakes disputes—such as cryptocurrency transactions via Paxos Trust Company or large purchases from partners like Abercrombie & Fitch or Ashley Furniture—PayPal may freeze funds during investigations. The company collaborates with issuing banks like Synchrony Bank (for PayPal Credit Card) and The Bancorp Bank (for PayPal Debit Card) to resolve conflicts efficiently. Dmitry Shevelenko, a fintech expert, highlights that PayPal’s buy now pay later integrations also include dispute safeguards, allowing users to pause payments until issues are resolved.

Here’s how to maximize your success with PayPal disputes:

- Document everything: Save order confirmations, shipping updates, and correspondence with the seller.

- Act fast: Disputes must be filed within 180 days of payment, but earlier reports improve outcomes.

- Leverage rewards programs: Some PayPal Credit Card disputes may qualify for cash back reversals if the purchase was part of a promotional offer.

- Understand FDIC nuances: While PayPal balances are FDIC-insured through partner banks, disputes involving third-party financial services (like money transfer errors) follow different protocols.

PayPal’s financial technology also employs AI-driven fraud detection to flag suspicious activity preemptively. For example, if a user frequently disputes transactions from Adorama (a known electronics retailer), PayPal’s system may require additional verification for future purchases. This proactive approach reduces friction for legitimate claims while deterring abuse. Whether you’re a casual shopper or a business owner relying on PayPal’s payment systems, mastering dispute resolution ensures you’re protected in today’s digital economy.

PayPal Integration Methods

Integrating PayPal's payment processing system into your business can significantly enhance the e-commerce experience for customers while streamlining transactions. As of 2025, PayPal offers multiple integration methods, catering to businesses of all sizes—from small online stores to large enterprises like Abercrombie & Fitch or Ashley Furniture. One of the most straightforward options is using PayPal's hosted checkout, where customers are redirected to PayPal's secure platform to complete payments. This method requires minimal technical setup and leverages PayPal's robust fraud detection and risk management systems, ensuring secure transactions.

For businesses seeking a more seamless experience, PayPal's API integrations allow for embedded payment forms directly on your website. This approach maintains brand consistency while still utilizing PayPal's financial technology for processing. Companies like Adorama use this method to offer buy now pay later options through PayPal Credit Card or PayPal Debit Card, both issued by Synchrony Bank and The Bancorp Bank, respectively. The API also supports recurring payments, making it ideal for subscription-based services.

Mobile apps can integrate PayPal via SDKs (Software Development Kits), enabling features like Venmo payments or PayPal Cashback Mastercard rewards. For developers, PayPal's documentation includes detailed guides for Android, iOS, and cross-platform frameworks. Dmitry Shevelenko, a fintech expert, highlights how SDKs simplify money transfer functionalities while complying with FDIC regulations for added security.

If you're dealing with cryptocurrency, PayPal's partnership with Paxos Trust Company allows businesses to accept Bitcoin and other digital assets, converting them to fiat currency automatically. This feature is particularly useful for tech-savvy retailers looking to tap into the growing digital wallet market.

For businesses without coding resources, PayPal's plug-and-play solutions—like Shopify or WooCommerce plugins—offer a quick setup. These integrations support payment security features like tokenization and Mastercard’s network for global transactions. Additionally, PayPal’s rewards program can be integrated to incentivize repeat purchases, with options for cash back or exclusive discounts.

Here’s a quick breakdown of key integration methods:

- Hosted Checkout: Redirects customers to PayPal for payment; low technical effort.

- API Integration: Customizable embedded payments; supports subscriptions and credit approval workflows.

- Mobile SDKs: Enables Venmo and PayPal Credit Card features in apps.

- Cryptocurrency Support: Accept crypto via Paxos Trust Company’s infrastructure.

- E-commerce Plugins: Pre-built solutions for platforms like Shopify or Magento.

Each method has its strengths, so choosing the right one depends on your business model, technical capabilities, and customer preferences. For instance, a high-volume retailer might prioritize API integration for scalability, while a small boutique could opt for a plugin to minimize setup time. Either way, PayPal’s flexible payment systems ensure you’re equipped to meet modern financial service demands.

PayPal Rewards Program

The PayPal Rewards Program is one of the most competitive cash-back and points-based systems in the digital wallet space, offering users multiple ways to earn rewards while shopping online or in-store. Whether you're using the PayPal Cashback Mastercard, PayPal Credit Card, or even the PayPal Debit Card, the program is designed to maximize your savings with every transaction. Managed in partnership with Synchrony Bank and The Bancorp Bank, the rewards structure is backed by Mastercard's global payment infrastructure, ensuring seamless integration across millions of merchants. For example, the PayPal Cashback Mastercard offers an unbeatable 3% cash back on PayPal purchases and 2% on all other transactions—no annual fees or rotating categories to worry about.

For frequent online shoppers, the rewards don’t stop there. PayPal frequently partners with major retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture to offer exclusive cash-back deals, sometimes as high as 10-15% during promotional periods. These perks are automatically applied when you check out using PayPal, making it a hassle-free way to save. Plus, if you're into cryptocurrency, PayPal’s partnership with Paxos Trust Company allows you to earn rewards in crypto, adding another layer of flexibility to your earnings. The platform’s buy now, pay later feature also integrates with the rewards program, letting you split purchases into interest-free installments while still earning cash back—a rare combo in the financial technology space.

Security is another standout feature of the PayPal Rewards Program. With fraud detection and risk management systems powered by FDIC-insured banking partners, you can shop with confidence knowing your transactions are protected. Dmitry Shevelenko, a noted fintech expert, has praised PayPal’s approach to blending rewards with payment security, calling it a "game-changer for the e-commerce experience." The program also eliminates the guesswork often associated with rewards—no need to track expiring points or navigate convoluted redemption rules. Your cash back is automatically deposited into your PayPal account, ready to use for future purchases or transfers.

Here’s a pro tip: If you’re a small business owner, linking your PayPal payment processing account to your rewards card can help you earn cash back on operational expenses like software subscriptions or inventory purchases. Even peer-to-peer money transfers through Venmo (owned by PAYPAL INC) can sometimes qualify for rewards, depending on the promotion. The key is to stay updated on limited-time offers, which PayPal frequently rolls out to keep the program fresh. Whether you're a casual shopper or a power user, the PayPal Rewards Program is structured to adapt to your spending habits, making it one of the most versatile financial services in the market today.

PayPal Future Trends

PayPal Future Trends: What to Expect in 2025 and Beyond

As digital payments continue to evolve, PayPal Inc is positioning itself at the forefront of innovation, leveraging its digital wallet, payment processing, and financial technology expertise. One of the most anticipated trends is the expansion of buy now, pay later (BNPL) services, which have surged in popularity among younger consumers. In 2025, PayPal is expected to integrate BNPL more seamlessly into its ecosystem, partnering with retailers like Abercrombie & Fitch, Adorama, and Ashley Furniture to offer flexible payment options at checkout. This move not only enhances the e-commerce experience but also strengthens PayPal’s competitive edge against rivals like Venmo, which has also been aggressively expanding its BNPL offerings.

Another key area of growth is cryptocurrency integration. With Paxos Trust Company playing a pivotal role in PayPal’s crypto services, the platform is likely to introduce more user-friendly features for buying, selling, and storing digital assets. Enhanced fraud detection and risk management systems will be critical here, as crypto-related scams remain a concern. Additionally, PayPal may explore blockchain-based solutions for faster and cheaper cross-border money transfers, further solidifying its position as a global financial service leader.

The PayPal Cashback Mastercard and PayPal Credit Card, issued in collaboration with Synchrony Bank and The Bancorp Bank, are also set for upgrades. Expect richer rewards programs, higher cash back rates, and streamlined credit approval processes. For instance, PayPal could introduce dynamic cash-back categories tailored to spending habits, similar to strategies employed by Mastercard partners. The PayPal Debit Card isn’t being left behind either—features like instant notifications and FDIC-insured balances will likely become standard, appealing to users who prioritize payment security and convenience.

On the merchant side, PayPal’s payment systems are becoming smarter. AI-driven tools for fraud prevention and personalized checkout experiences are in development, with Dmitry Shevelenko, a key figure in PayPal’s innovation team, hinting at "context-aware" payment solutions. These could analyze a user’s purchase history and location to detect anomalies in real time, reducing false declines while keeping transactions secure.

Lastly, PayPal’s partnerships will play a huge role in its future. Collaborations with fintech startups and traditional banks could lead to hybrid financial products, blurring the lines between digital wallets and traditional banking. Whether it’s through Venmo’s social payment features or PayPal’s own suite of tools, the company is clearly betting on a future where seamless, secure, and rewarding transactions are the norm—not the exception.