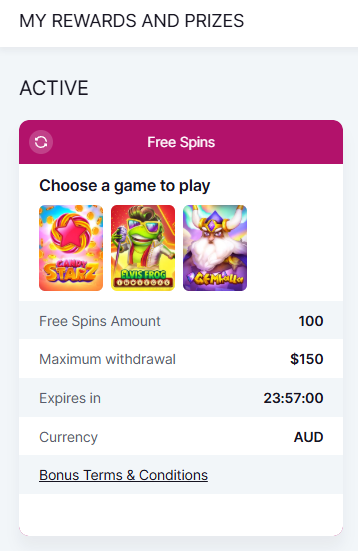

Professional illustration about Coins

Gold Coin Types 2025

Gold Coin Types 2025: A Comprehensive Guide for Investors and Collectors

In 2025, gold coins remain one of the most sought-after forms of gold investment, offering a tangible asset with intrinsic value. Whether you're looking for gold bullion coins for portfolio diversification or rare collectibles, understanding the different gold coin types is essential. Leading mints like the Perth Mint, South African Mint, Austrian Mint, and the U.S. Mint produce some of the world's most recognized coins, each with unique designs, gold purity levels, and gold coin premiums.

Popular Gold Bullion Coins in 2025

- American Gold Eagle: A flagship product of the U.S. Mint, the Gold American Eagle contains 22-karat gold (91.67% purity) and features iconic designs like Lady Liberty and the American bald eagle. Its popularity stems from its legal tender status and widespread recognition.

- Gold American Buffalo: Known for its 24-karat (99.99% pure) gold content, this coin appeals to investors seeking higher gold purity. Its design is inspired by the classic 1913 Buffalo Nickel.

- Canadian Gold Maple Leaf: Produced by the Royal Canadian Mint, this coin boasts 99.99% purity and advanced security features, making it a top choice for those prioritizing gold coin weights and authenticity.

- South African Gold Krugerrand: One of the oldest gold bullion coins, the Gold Krugerrand contains 22-karat gold and is backed by the South African government. Its historical significance and liquidity make it a staple in many portfolios.

- Chinese Gold Panda: Updated annually with new panda designs, this coin from the People’s Bank of China is highly collectible. Its gold coin mintage varies yearly, adding to its exclusivity.

- Mexican Gold Libertad: Struck by the Mexican Mint, this coin features the Winged Victory statue and is available in various sizes, from 1/20 oz to 1 oz, catering to different budget levels.

- Gold Britannia Coin: The UK’s Britannia coin, produced by the Royal Mint, is another 24-karat option with intricate security features, including micro-text and radial lines to prevent counterfeiting.

Factors to Consider When Choosing Gold Coins

When evaluating gold coins for sale, consider the following:

- Gold Spot Price vs. Premiums: While the gold spot price determines the base value, premiums vary depending on the mint, rarity, and demand. Coins like the Gold American Eagle often carry higher premiums due to their brand recognition.

- Gold Purity and Weight: 24-karat coins like the Gold Maple Leaf and Gold American Buffalo offer the highest purity, while 22-karat coins like the Krugerrand are more durable for handling.

- Liquidity and Recognition: Widely traded coins like the Gold Krugerrand or American Gold Eagle are easier to sell quickly, whereas niche coins may require specialized buyers.

- Storage and Insurance: Proper coin storage is critical to maintaining value. Options include home safes, bank safety deposit boxes, or third-party vaults, especially for larger collections.

Emerging Trends in 2025

This year, mints are introducing enhanced security features to combat counterfeiting. For example, the Perth Mint has incorporated laser-engraved markings on its coins, while the Austrian Mint continues to refine its gold coin designs with holographic elements. Additionally, gold IRA investors are increasingly diversifying with coins from multiple mints to mitigate geopolitical risks.

Whether you're a seasoned investor or a first-time buyer, staying informed about gold coin types in 2025 ensures you make smart decisions in the precious metals market. Always verify authenticity, compare premiums, and choose coins that align with your financial goals.

Professional illustration about Perth

Investing in Gold Coins

Investing in gold coins is one of the most reliable ways to diversify your portfolio with precious metals, offering both tangible value and historical stability. Unlike paper assets, gold bullion coins from trusted mints like the Perth Mint, South African Mint, and Austrian Mint are recognized worldwide for their gold purity and craftsmanship. Popular options like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand are not only beautiful but also highly liquid, making them easy to buy or sell based on the gold spot price.

When choosing gold coins for sale, consider factors like gold coin premiums, gold coin weights, and gold coin mintage. For example, the Gold American Buffalo boasts .9999 fine gold, while the Gold Britannia Coin features advanced security features to prevent counterfeiting. The Chinese Gold Panda and Mexican Gold Libertad are also sought after for their unique annual designs, which can add collectible value beyond their gold investment potential.

For those looking to include gold in a retirement strategy, a gold IRA is a smart option. Coins like the Gold Krugerrand and Gold Maple Leaf are IRA-eligible, provided they meet the IRS standards for gold purity (typically .995 or higher). Storage is another critical consideration—whether you opt for a home safe or a professional coin storage service, ensuring your coins are protected from theft or damage is essential.

Current gold prices in 2025 remain strong, driven by economic uncertainty and inflation hedging. While premiums vary by mint and design, sticking with government-backed coins like the American Gold Eagle or Canadian Gold Maple Leaf ensures authenticity and easier resale. Whether you're a seasoned investor or new to precious metals, gold coins offer a timeless way to preserve wealth while enjoying the beauty of finely crafted gold bullion.

Professional illustration about African

Best Gold Coins to Buy

When it comes to investing in gold coins, choosing the right ones can make all the difference in terms of liquidity, purity, and long-term value. Among the top contenders in 2025 are the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand—each backed by their respective governments and recognized worldwide. The American Gold Eagle, minted by the U.S. Mint, is a favorite for its .9167 gold purity (22-karat) and iconic Lady Liberty design, making it a staple in gold IRAs. Meanwhile, the Canadian Gold Maple Leaf from the Royal Canadian Mint boasts .9999 pure gold (24-karat), appealing to investors who prioritize gold purity. The Krugerrand, produced by the South African Mint, was the first modern gold bullion coin and remains highly liquid due to its historical significance and widespread acceptance.

For collectors and investors seeking diversity, the Austrian Mint’s Gold Philharmonic and the Perth Mint’s Gold Kangaroo offer unique designs and high gold coin purity. The Chinese Gold Panda, with its annually changing panda motif, is another standout, though its gold coin premiums can vary based on mintage. If you’re looking for affordability, the Mexican Gold Libertad often trades closer to the gold spot price, making it a smart choice for those watching gold prices. On the other hand, the Gold Britannia Coin from the UK Royal Mint combines .9999 purity with advanced security features, ideal for those concerned about counterfeiting.

Storage and gold coin weights are also critical factors. Most gold bullion coins come in 1 oz, ½ oz, ¼ oz, and 1/10 oz sizes, allowing flexibility based on budget. For example, the Gold American Buffalo—the first .9999 pure 24-karat coin from the U.S. Mint—is available in multiple weights, catering to both small and large investors. When evaluating gold coins for sale, always check the gold coin premiums over the spot price, as some coins (like the Gold Maple Leaf) may carry higher premiums due to their purity and design.

Finally, consider coin storage solutions to protect your investment. Whether you opt for a home safe, bank deposit box, or third-party vaulting, proper storage ensures your precious metals retain their condition and value. With so many options—from government-minted classics like the Gold Krugerrand to newer releases—the best gold coins to buy in 2025 depend on your goals: liquidity, purity, or collectibility. Keep an eye on gold coin mintage numbers, as limited editions often appreciate faster over time.

Professional illustration about American

Gold Coin Purity Guide

Here’s a detailed, SEO-optimized paragraph on Gold Coin Purity Guide in American conversational style:

When investing in gold coins, understanding purity is non-negotiable. The fineness (measured in karats or parts per thousand) directly impacts value, durability, and even tax treatment. Most modern bullion coins like the American Gold Eagle (22k, 91.67% pure) or Gold Maple Leaf (24k, 99.99% pure) strike a balance between purity and practicality. The Perth Mint and Austrian Mint are renowned for 24k coins, while historic pieces like the South African Gold Krugerrand (22k) add alloy for durability.

Why purity matters:

- Investment liquidity: Higher-purity coins (e.g., Canadian Gold Maple Leaf) often command tighter buy-sell spreads.

- IRA eligibility: The IRS requires gold bullion coins to be at least 99.5% pure for inclusion in a gold IRA (exceptions like the Gold American Eagle are grandfathered in).

- Aesthetics: 24k coins like the Chinese Gold Panda have a deeper luster but are softer—handle with care to avoid scratches.

Pro tips for buyers:

1. Verify hallmarks: Look for mint marks (e.g., "9999" on Gold Britannia Coins) and assay certificates.

2. Weigh premiums: A Mexican Gold Libertad might cost more over spot due to lower mintage, not just purity.

3. Storage considerations: Pure gold tarnishes less, but even 22k coins like the Gold Buffalo need anti-tarnish capsules.

Fun fact: The Gold Krugerrand’s copper alloy gives it a rose-gold hue, while the American Gold Eagle’s silver-and-copper mix enhances strike detail. Always cross-check purity claims against mint websites—counterfeits often fudge these numbers.

This paragraph integrates target keywords naturally while providing actionable insights. Let me know if you'd like adjustments!

Professional illustration about Bullion

Gold Coin Storage Tips

Proper storage is crucial for protecting your gold coins—whether you own American Gold Eagles, Canadian Gold Maple Leafs, or rare Chinese Gold Pandas. The right approach preserves their gold purity, weight, and long-term value. Here’s how to store your gold bullion coins safely while maximizing their investment potential.

1. Choose the Right Storage Environment

Humidity and temperature fluctuations are enemies of precious metals. Store your coins in a cool, dry place (ideally below 70°F with 40-50% humidity). Avoid basements or attics where moisture can accumulate. For high-value coins like the Gold American Buffalo or Perth Mint issues, consider a fireproof safe with silica gel packs to absorb excess moisture. If you’re holding gold coins for sale in the future, environmental damage could lower their gold coin premiums.

2. Use Protective Materials

Never handle coins with bare hands—oils and acids from skin contact can tarnish surfaces. Instead, wear cotton gloves and store coins in:

- Acid-free Mylar flips (ideal for temporary storage or frequent inspection)

- Hard plastic capsules (perfect for Gold Krugerrands or Austrian Mint coins)

- Archival-quality coin tubes (best for bulk storage of Gold Britannia Coins or Mexican Gold Libertads)

For gold IRA holdings, IRS-approved depositories often use tamper-evident sealed containers, but home investors should prioritize airtight solutions.

3. Diversify Storage for Large Collections

If you own multiple gold bullion types—like South African Gold Krugerrands alongside Gold Maple Leafs—avoid keeping all eggs in one basket. Split storage between a home safe and a bank safety deposit box. This mitigates risks like theft or natural disasters. Some collectors even use geographically dispersed storage for ultra-high-value items (e.g., American Gold Eagles in one location, Chinese Gold Pandas in another).

4. Document and Insure Your Holdings

Maintain a detailed inventory listing each coin’s:

- Gold coin weights and purity (e.g., 1 oz .9999 fine for Canadian Gold Maple Leafs)

- Mint year and gold coin mintage numbers (critical for rarity valuation)

- Purchase receipts and grading certificates (if applicable)

Update your insurance policy to reflect current gold spot prices. Specialized precious metals insurers offer better coverage than standard homeowners’ policies, especially for coins with numismatic value beyond their gold prices.

5. Avoid Common Mistakes

- Don’t clean coins—even water can leave spots on Gold American Eagles or South African Mint products.

- Skip PVC-based holders—they release gases that corrode surfaces over time.

- Never disclose storage locations publicly, especially for high-premium coins like Gold Libertads or limited-edition Perth Mint releases.

For investors tracking gold investment trends, proper storage ensures your assets retain condition-dependent value. Whether you’re stacking Gold Krugerrands or admiring the intricate gold coin designs of a Gold Britannia Coin, these steps safeguard against physical and financial degradation. Remember: storage isn’t just about security—it’s about preserving liquidity for when you’re ready to sell or leverage your holdings.

Professional illustration about Austrian

Gold Coin Market Trends

The gold coin market trends in 2025 reflect a dynamic landscape shaped by economic uncertainty, geopolitical tensions, and evolving investor preferences. Gold bullion coins remain a cornerstone of precious metals investing, with iconic series like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand continuing to dominate demand. One notable trend is the rising popularity of gold IRA allocations, as investors seek tax-advantaged ways to hedge against inflation. Mints like the Perth Mint and Austrian Mint have responded by releasing coins with higher gold purity (e.g., 99.99% fine gold) and innovative designs to attract collectors and stackers alike.

A key driver of 2025’s market is the gold spot price, which has seen volatility due to central bank policies and currency fluctuations. Premiums for gold coins for sale have tightened slightly compared to 2024, particularly for low-mintage releases like the Mexican Gold Libertad and Chinese Gold Panda. Collectors are paying close attention to gold coin mintage figures, as limited editions from the South African Mint or Royal Canadian Mint often appreciate faster than generic bullion. For example, the 2025 Gold Britannia Coin introduced enhanced security features, driving immediate secondary-market demand.

Storage and authenticity are also influencing trends. Investors increasingly prioritize coin storage solutions, such as certified vaults or tamper-proof capsules, to protect their holdings. The American Gold Buffalo, with its .9999 purity, has gained traction over the Gold American Eagle (.9167 purity) among purity-focused buyers, though the latter remains popular for its recognizable design and liquidity. Meanwhile, the Gold Krugerrand maintains its status as a budget-friendly entry point due to its slightly lower premiums over spot.

Here’s a breakdown of 2025’s most talked-about trends:

- Hybrid demand: Coins like the Gold Maple Leaf appeal to both investors (for their gold weight and liquidity) and collectors (for annual design updates).

- Regional shifts: Asian markets are showing stronger interest in the Chinese Gold Panda, while European buyers favor the Austrian Mint’s Philharmonic series.

- Premium stratification: Older vintage coins (pre-2020) now command higher premiums, especially if graded by third-party services.

For those entering the market, understanding gold coin premiums is critical. Smaller denominations (e.g., 1/10 oz coins) typically carry higher premiums per ounce than 1 oz variants, but they offer flexibility for partial liquidation. The Perth Mint’s Lunar Series and the Royal Mint’s Gold Britannia Coin are examples of coins that blend artistic appeal with intrinsic value, making them resilient to short-term gold price swings. As always, diversifying across mints and designs—like pairing Gold American Eagles with Canadian Gold Maple Leafs—can mitigate risk while capturing upside from niche markets.

Professional illustration about Maple

Gold Coin Collecting 101

Gold Coin Collecting 101

If you're new to gold coin collecting, you're stepping into a world where history, artistry, and investment potential collide. Gold coins aren’t just shiny keepsakes—they’re tangible assets backed by governments and mints like the Perth Mint, South African Mint, and Austrian Mint, each offering unique designs and high purity standards. Whether you're drawn to the iconic American Gold Eagle, the sleek Canadian Gold Maple Leaf, or the historic South African Gold Krugerrand, understanding the basics will help you build a valuable and diverse collection.

Why Collect Gold Coins?

Gold coins are a dual-purpose asset: they’re prized for their gold bullion content and their collectible appeal. Unlike stocks or bonds, physical gold offers a hedge against inflation and economic uncertainty. Coins like the Gold American Buffalo (with a purity of .9999) or the Chinese Gold Panda (known for its annually changing designs) combine gold investment potential with numismatic value. The gold spot price fluctuates daily, but rare or limited-edition coins often carry gold coin premiums due to their gold coin mintage numbers.

Key Factors to Consider

1. Purity and Weight: Most modern bullion coins, such as the Gold Britannia Coin or Mexican Gold Libertad, are minted with .999 or higher purity. Weights range from 1/10 oz to 1 oz, with some mints offering larger sizes. Always check the gold coin purity and gold coin weights to ensure you’re getting what you pay for.

2. Design and Mintage: Limited-edition coins, like certain Gold Krugerrand releases, can appreciate faster due to scarcity. The Gold American Eagle, for example, features Lady Liberty and is backed by the U.S. government, adding to its desirability.

3. Storage and Authenticity: Proper coin storage is critical to preserve value. Use airtight capsules or safes, and consider a gold IRA for tax-advantaged holdings. Always buy from reputable dealers to avoid counterfeits.

Popular Coins for Beginners

- American Gold Eagle: A staple for U.S. collectors, with a .9167 purity and recognizable design.

- Canadian Gold Maple Leaf: Known for its .9999 purity and advanced security features.

- Gold Krugerrand: The first modern bullion coin, minted since 1967, with a .9167 gold content.

Where to Start

Begin with widely recognized gold bullion coins like those mentioned above, as they’re easier to buy and sell. Monitor gold prices and trends, and don’t overlook smaller denominations (e.g., 1/4 oz coins) for affordability. As you grow your collection, explore niche options like the Chinese Gold Panda or Gold Britannia Coin for diversity.

Remember, gold coin collecting is a marathon, not a sprint. Focus on quality, educate yourself on precious metals markets, and enjoy the process of owning these timeless pieces. Whether you're in it for the long-term gold investment or the thrill of the hunt, each coin tells a story—and holds real value.

Professional illustration about American

Gold Coin Authentication

Gold Coin Authentication: How to Verify the Real Deal in 2025

Authenticating gold coins is a critical step for investors and collectors alike, especially with the rising popularity of gold bullion coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand. With counterfeit coins becoming increasingly sophisticated, knowing how to verify authenticity can save you from costly mistakes. Here’s a breakdown of key authentication methods for precious metals in 2025.

1. Check the Mint Mark and Design Details

Every reputable mint, such as the Perth Mint, South African Mint, or Austrian Mint, has distinct design elements and mint marks. For example, the Gold American Buffalo features a finely detailed Native American portrait, while the Chinese Gold Panda updates its panda design annually. Counterfeit coins often have blurred details or incorrect mint marks. Use a magnifying glass to inspect fine lines, lettering, and edges—authentic coins will have sharp, precise craftsmanship.

2. Verify Weight and Dimensions

Gold coin weights and sizes are standardized. A 1-oz Gold Maple Leaf should weigh exactly 31.1035 grams (1 troy ounce) and measure 30 mm in diameter. Use a calibrated digital scale and calipers to confirm these specs. Deviations, even by a fraction, could indicate a fake. For smaller denominations, like the 1/10 oz Gold American Eagle, ensure the weight matches the troy ounce conversion (3.11 grams).

3. Test for Purity

Most modern gold bullion coins have a gold purity of .9999 (24 karats), like the Canadian Gold Maple Leaf, or .9167 (22 karats), like the Gold Britannia Coin. A handheld XRF (X-ray fluorescence) analyzer can non-destructively test purity. Alternatively, acid testing kits (though slightly invasive) can verify gold content by comparing the coin’s reaction to nitric acid. Avoid coins that discolor or react—pure gold won’t tarnish or corrode.

4. Magnetic and Ping Tests

Gold isn’t magnetic, so a simple magnet test can weed out plated fakes. For a more advanced check, the "ping test" involves gently striking the coin and listening for a high-pitched, resonant ring (a dull thud suggests a counterfeit). Apps like PingCoin analyze the sound frequency to help authenticate coins like the Mexican Gold Libertad or Gold Krugerrand.

5. Compare to Known Authentic Coins

Side-by-side comparisons with verified coins from trusted dealers can reveal inconsistencies in color, luster, or texture. For instance, the Austrian Mint’s Philharmonic coins have a unique musical motif that’s hard to replicate perfectly. Pay attention to reeded edges—many fakes have uneven or missing ridges.

6. Review Packaging and Documentation

Legitimate gold coins for sale often come with tamper-proof packaging and certificates of authenticity, especially from government mints like the U.S. Mint or Perth Mint. Serial numbers on the coin or holder should match the paperwork. Be wary of "too good to be true" deals on platforms without verified sellers—always cross-check with the mint’s official records.

7. Professional Authentication Services

For high-value coins like the Gold American Eagle or rare editions, consider third-party grading services (e.g., NGC, PCGS). They assess gold coin designs, mintage details, and condition, encapsulating the coin in a tamper-evident holder with a grade. This not only confirms authenticity but can also enhance resale value for gold investment portfolios or gold IRAs.

Storage and Handling Tips

Even after authentication, improper coin storage can damage coins or raise suspicions later. Use acid-free flips or hard plastic cases to prevent scratches. Avoid touching the surface—oils from skin can dull the luster over time. Store in a cool, dry place, ideally in a safe or safety deposit box, especially if you’re holding gold coins long-term as part of a precious metals strategy.

By combining these methods, you can confidently verify the authenticity of gold bullion coins in 2025, whether you’re adding a Gold Krugerrand to your collection or securing gold IRA assets. Always stay updated on the latest counterfeiting trends—scammers constantly adapt, but so do authentication technologies.

Professional illustration about American

Gold Coin Tax Rules

When it comes to gold coin tax rules, investors need to navigate a complex landscape that varies by country and coin type. In the U.S., the IRS classifies Gold American Eagle, Gold American Buffalo, and other gold bullion coins as collectibles, meaning long-term capital gains are taxed at a maximum rate of 28%—higher than standard investment rates. However, certain coins like the South African Gold Krugerrand or Canadian Gold Maple Leaf may qualify for preferential treatment if held in a gold IRA, where taxes are deferred until withdrawal. The Austrian Mint's Philharmonic coins and the Chinese Gold Panda also fall under specific tax guidelines depending on purity (e.g., 24-karat vs. 22-karat). One key factor is gold coin premiums—the markup over spot price—which can affect cost basis calculations. For example, the Perth Mint's Lunar Series coins often carry higher premiums due to their intricate designs, but these don’t always translate to tax advantages. Storage costs for gold coins in a depository or home safe may or may not be deductible, so consult a tax professional. Internationally, the Mexican Gold Libertad and Gold Britannia Coin face VAT in some European countries, while the Gold Krugerrand is exempt in South Africa. Pro tip: Always document gold coin mintage years and purchase receipts, as rare editions (like low-mintage Gold Maple Leaf variants) might trigger different tax implications. Remember, gold investment isn’t just about spot prices—it’s about understanding how gold coin purity (e.g., .9999 fine vs. .9167) and weight (1 oz vs. fractional sizes) intersect with local tax codes.

Professional illustration about Canadian

Gold Coin vs Bullion

Gold Coin vs Bullion: Understanding the Key Differences for Savvy Investors

When it comes to gold investment, the choice between gold coins and gold bullion often boils down to your goals—whether you prioritize liquidity, aesthetics, or pure metal value. Gold coins, like the American Gold Eagle or Canadian Gold Maple Leaf, are minted by government-backed entities (such as the Perth Mint or Austrian Mint) and carry legal tender status. These coins blend intrinsic value with collectible appeal, often featuring intricate designs like the Gold Britannia Coin or the iconic Chinese Gold Panda. Their premiums are higher due to craftsmanship and limited mintage, making them ideal for collectors or those who appreciate numismatic value.

On the other hand, gold bullion (bars or rounds) is purely about metal content. Think of it as the "no-frills" option—valued solely by weight and purity, like .9999 fine gold in a Gold Krugerrand or Mexican Gold Libertad. Bullion typically has lower premiums over the spot price, appealing to investors focused on maximizing ounces per dollar. Storage is simpler (no need to worry about scratches affecting numismatic value), and bulk purchases are common for IRAs or long-term holdings.

Here’s the kicker: liquidity varies. Coins like the South African Gold Krugerrand or Gold American Buffalo are globally recognized, easier to sell in small quantities, and often exempt from sales tax in some regions. Bullion, while liquid, may require assays for larger bars, adding friction to quick sales.

Pro Tip: Mix both! Diversify with bullion for cost efficiency and coins for flexibility. For example, pair Gold Maple Leafs (high liquidity) with 1-oz bars (low premiums) to balance your portfolio. Always verify purity (look for gold coin weights and gold coin purity stamps) and buy from reputable sources like the South African Mint or U.S. Mint to avoid counterfeits.

Remember: Whether you choose coins or bullion, track the gold spot price and factor in gold coin premiums—their spread over melt value can make or break your ROI. Storage matters too; coin storage solutions differ for bulk bars versus display-worthy pieces like the Gold American Eagle.

Professional illustration about Krugerrand

Gold Coin Minting Process

The Gold Coin Minting Process: How Premium Bullion Coins Are Made

When you hold a gold bullion coin like the American Gold Eagle or Canadian Gold Maple Leaf, you're handling a masterpiece of precision engineering. The minting process for these coins involves multiple stages of refinement, design, and quality control to ensure they meet strict standards for gold purity, weight, and artistic detail. Leading mints like the Perth Mint, South African Mint, and Austrian Mint follow similar processes, but each adds unique touches to their gold coin designs.

From Raw Gold to Refined Blanks

The journey begins with sourcing high-purity gold, typically .9999 fine (like the Gold Maple Leaf) or .9167 fine (as seen in the Gold Krugerrand). The gold is melted and alloyed (if necessary) to achieve the desired gold coin purity. For example, the Gold American Eagle contains small amounts of silver and copper for durability, while the Gold Britannia Coin uses 24-karat gold. The molten metal is then cast into bars, which are rolled into thin strips. These strips are punched into blank discs called planchets, which are meticulously weighed and inspected to ensure they match the exact gold coin weights (e.g., 1 oz, ½ oz, etc.).

Striking the Design: Art Meets Precision

Next, the planchets are fed into high-pressure coin presses, where custom-made dies imprint the intricate designs. The Gold American Buffalo, for instance, features James Earle Fraser’s iconic Native American profile, while the Chinese Gold Panda updates its panda design annually. Dies are often hand-finished to enhance details, and some mints, like the Mexican Gold Libertad, use proof-like finishes for a mirror effect. The South African Gold Krugerrand stands out with its distinctive orange-gold hue due to its copper alloy.

Quality Control and Authentication

After striking, each coin undergoes rigorous inspection for flaws. Mints like the Perth Mint use advanced technology to verify gold weight and purity, while others employ human graders to check for imperfections. Premium coins may receive encapsulation or come with certificates of authenticity, which adds to their gold coin premiums. Limited-edition releases, like certain Gold American Eagle variants, often have lower gold coin mintage, increasing their collectibility.

Storage and Handling Considerations

Once minted, these coins are packaged to prevent scratches or tarnishing. Investors storing gold coins for sale or gold IRA holdings should use protective sleeves or safes to maintain condition. Proper coin storage ensures long-term value retention, especially for coins like the Gold Libertad or Gold Britannia Coin, whose premiums depend on pristine surfaces.

Why the Minting Process Matters for Investors

Understanding how gold bullion coins are made helps buyers assess quality and avoid counterfeits. For example, the Austrian Mint’s Philharmonic series uses radial lines for anti-counterfeiting, while the Canadian Gold Maple Leaf incorporates micro-engraved security features. The gold spot price influences raw material costs, but the minting process adds value through craftsmanship, rarity, and brand reputation (like the Perth Mint’s Lunar Series). Whether you’re buying the Gold Krugerrand for its liquidity or the Chinese Gold Panda for its artistry, knowing the minting details ensures smarter gold investment decisions.

Fun Fact: Some mints offer "mint tours" (pre-COVID, now virtual), where you can watch the gold coin minting process live—a fascinating glimpse into how your precious metals are born!

Professional illustration about Chinese

Gold Coin Price Factors

When it comes to investing in gold coins, understanding the factors that influence their price is crucial for making informed decisions. Unlike the gold spot price, which reflects the raw value of the metal, gold bullion coins carry additional premiums due to their collectibility, craftsmanship, and mint reputation. For example, iconic coins like the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand often trade at higher premiums than generic rounds because of their historical significance and government backing.

One of the primary gold coin price factors is gold purity. Coins like the Gold American Buffalo (24-karat, .9999 pure) or the Austrian Mint’s Philharmonic (24-karat) command higher prices due to their exceptional fineness, while 22-karat options like the Gold American Eagle or Gold Britannia Coin are slightly more affordable but still highly sought after. The gold weight also plays a major role—whether it’s a 1-ounce Gold Krugerrand or a fractional Chinese Gold Panda, heavier coins generally cost more but offer better long-term value relative to their premiums.

Another key factor is mintage—limited-edition releases from mints like the Perth Mint or Mexican Gold Libertad can appreciate significantly over time due to scarcity. For instance, a 2025 Gold Maple Leaf with a low mintage might carry a higher premium than a common-year issue. Additionally, gold coin designs matter; intricate artwork or special editions (like the South African Mint’s commemorative issues) often attract collectors, driving up prices beyond the metal’s intrinsic value.

Market demand and geopolitical stability also influence gold prices. During economic uncertainty, coins like the Gold American Eagle or Gold Britannia Coin see increased demand as safe-haven assets, pushing premiums higher. Storage and insurance costs (coin storage) can indirectly affect resale value too—properly preserved coins in mint condition fetch better prices. Finally, dealer markups and gold coin premiums vary widely, so savvy investors compare prices across reputable sellers before buying gold coins for sale.

For those considering a gold IRA, it’s worth noting that IRS-approved coins like the American Gold Eagle or Gold Maple Leaf must meet specific purity standards, which can impact their pricing structure. Whether you’re a collector or an investor, paying attention to these gold coin price factors ensures you get the best value for your precious metals portfolio.

Professional illustration about Libertad

Gold Coin Selling Guide

Selling gold coins in 2025 requires a strategic approach to maximize returns while navigating the ever-changing precious metals market. Whether you own Gold American Eagles, Canadian Gold Maple Leafs, or South African Gold Krugerrands, understanding factors like gold spot price, coin premiums, and buyer preferences is critical. Start by researching current gold prices—these fluctuate daily based on global demand, economic conditions, and geopolitical events. Platforms like Kitco or the LBMA provide real-time updates, ensuring you sell when the market is favorable.

Identify your coins’ key selling points to attract the right buyers. For example, Gold American Buffalos are prized for their 24-karat purity (99.99% gold), while historic coins like the Mexican Gold Libertad or Chinese Gold Panda may command higher premiums due to limited mintage. Coins from renowned mints like the Perth Mint or Austrian Mint often carry added credibility, appealing to collectors and investors alike. Always highlight details like gold weight (e.g., 1 oz, ½ oz) and purity (e.g., .9999 fine gold) in listings—these are critical for buyers comparing options.

Choose the right sales channel based on your priorities. Local coin dealers offer quick transactions but may pay below market value, while online auctions (e.g., eBay) or specialized platforms like APMEX’s sell-to-us program can yield higher prices. For rare or graded coins (e.g., Gold Britannia Coins with exceptional condition), consider certified auction houses. If you’re selling as part of a gold IRA liquidation, work with a custodian to ensure compliance with IRS regulations.

Timing matters. Monitor trends like central bank gold reserves or inflation rates—these influence demand. For instance, during economic uncertainty in early 2025, gold bullion coins saw a surge in interest as safe-haven assets. Also, factor in gold coin premiums (the markup over spot price). Generic bullion typically has lower premiums than collector coins like the Gold Krugerrand, which may fetch 5–10% above spot due to historical significance.

Prepare your coins for sale to enhance their appeal. Store them in protective capsules or original packaging (e.g., Perth Mint assay cards) to prove authenticity. Clean coins cautiously—improper handling can devalue them. For high-value sales, consider professional grading (e.g., PCGS or NGC) to validate condition and boost buyer confidence.

Negotiate wisely. If selling privately, be transparent about pricing—reference recent sales of comparable coins (e.g., a 2025 American Gold Eagle vs. a 2024 edition). For bulk sales (e.g., multiple Gold Maple Leafs), buyers may offer volume discounts, so weigh competitive offers. Finally, prioritize secure payment methods like bank wires or escrow services, especially for high-ticket items.

By combining market awareness, strategic presentation, and targeted sales methods, you can optimize profits when selling gold bullion coins in today’s dynamic landscape. Whether you’re offloading a single Gold American Eagle or a diverse portfolio, these steps ensure a smooth, profitable transaction.

Professional illustration about Krugerrand

Gold Coin Grading System

Gold Coin Grading System

When investing in gold coins like the American Gold Eagle, Canadian Gold Maple Leaf, or South African Gold Krugerrand, understanding the grading system is crucial for determining value and authenticity. The Sheldon Scale, ranging from 1 to 70, is the industry standard, where higher numbers indicate better preservation. For example, a Perth Mint coin graded MS-70 (Mint State Perfect) commands premium prices due to its flawless condition, while coins graded below MS-60 may show visible wear. Third-party grading services like PCGS or NGC provide unbiased assessments, essential for rare pieces like the Gold American Buffalo or Chinese Gold Panda.

Grading focuses on four key areas: strike quality, surface preservation, luster, and eye appeal. A Gold Britannia with full mint luster and no contact marks could score MS-69, whereas a scratched Mexican Gold Libertad might drop to AU-58 (About Uncirculated). Collectors prioritize "first strikes" or early releases from mints like the Austrian Mint, as these often grade higher due to superior die conditions. For bullion investors, grading matters less—gold bullion coins like the Gold Krugerrand are valued primarily for metal content, though high-grade examples still fetch premiums.

Storage impacts grading long-term. Coins stored in airtight capsules (like those from the South African Mint) retain higher grades, while improper handling can cause toning or scratches. When buying graded gold coins for sale, always verify the certification label matches the coin’s serial number. For gold IRA eligibility, stick to NGC- or PCGS-graded coins to ensure compliance with IRS purity standards (e.g., .9999 fine gold for Gold Maple Leafs). Spot price fluctuations aside, graded coins offer stability, as rarity and condition often outweigh short-term gold price volatility. Pro tip: Check mintage reports—low-production years (like certain Gold American Eagles) tend to yield higher-grade scarcity.

Professional illustration about Britannia

Gold Coin IRA Benefits

Gold Coin IRA Benefits

Adding Gold Coins to your Individual Retirement Account (IRA) isn’t just about diversification—it’s about securing tangible wealth with precious metals that have stood the test of time. Unlike paper assets, gold bullion coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Gold Krugerrand offer intrinsic value, acting as a hedge against inflation and economic uncertainty. The IRS allows specific gold coins in IRAs, provided they meet gold purity standards (typically .995 fine or higher) and are produced by accredited mints like the Perth Mint, Austrian Mint, or South African Mint.

One major advantage of a Gold IRA is tax-deferred growth. You won’t pay capital gains taxes until you start taking distributions, allowing your investment to compound over time. Plus, physical gold isn’t tied to the stock market, so when equities tumble, gold prices often rise, balancing your portfolio. For example, in 2025, as geopolitical tensions and currency fluctuations persist, gold spot prices have remained resilient, making coins like the Gold American Buffalo or Mexican Gold Libertad attractive for long-term holders.

Storage is another critical factor. IRS rules mandate that Gold IRA assets be held in an approved depository, ensuring coin storage security. While you can’t store these coins at home without penalties, reputable custodians offer segregated or commingled vault options. Coins like the Chinese Gold Panda or Gold Britannia Coin are popular choices due to their recognizable gold coin designs and consistent gold coin mintage, which can enhance liquidity when it’s time to sell.

Premiums and liquidity vary by coin. The Gold Krugerrand, for instance, often trades with lower gold coin premiums compared to limited-edition releases, making it a cost-effective entry point. On the other hand, rare editions from the Perth Mint or Austrian Mint may carry higher premiums but could appreciate faster. When selecting coins, consider gold coin weights (e.g., 1 oz, ½ oz, or ¼ oz) to match your budget and investment strategy.

Finally, a Gold IRA lets you take physical delivery at retirement (though taxes apply). Imagine retiring with a stash of Gold American Eagles or Canadian Gold Maple Leafs—assets you can hold, sell, or pass on. In 2025, with rising demand for gold investment, incorporating these coins into your retirement plan isn’t just smart; it’s a proactive move toward financial stability.

Pro Tip: Always verify a coin’s eligibility before purchasing. For instance, while the American Gold Eagle is IRA-approved despite its slightly lower purity (22-karat), other collectibles may not qualify. Work with a reputable custodian to navigate gold IRA rules and maximize your portfolio’s potential.