Professional illustration about Cash

Cash App Basics 2025

Cash App Basics 2025

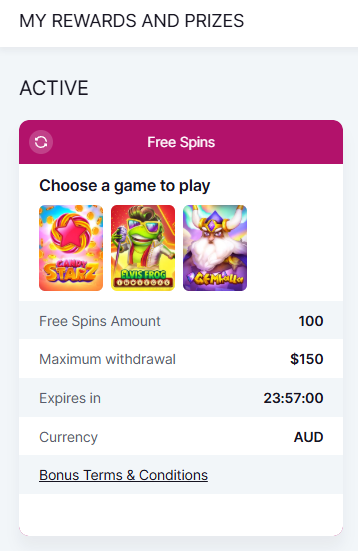

In 2025, Cash App remains one of the most popular financial services platforms for mobile banking, P2P payments, and even bitcoin trading. Owned by Block, Inc. (formerly Square), the app has evolved to offer a seamless blend of everyday banking and investment features. Whether you're sending money to friends, setting up direct deposit, or exploring stock investments, Cash App simplifies digital payments with its user-friendly interface.

One of the core features is the Cash App debit card, issued by Sutton Bank and linked to Visa, allowing users to spend their balance anywhere Visa is accepted. For those who prefer traditional banking integrations, Cash App also partners with Wells Fargo Bank, N.A. to facilitate smoother transactions. Unlike Zelle, which is tied to traditional bank accounts, Cash App operates as a standalone platform, giving users more flexibility in managing their money.

For investors, Cash App Investing LLC (a subsidiary of Block, Inc.) provides access to stock investing and bitcoin transactions. The platform is regulated by FINRA and protected by SIPC, ensuring a layer of security for your investments. In 2025, Cash App has expanded its bitcoin trading capabilities, integrating the Lightning Network for faster and cheaper transactions—a game-changer for crypto enthusiasts.

Security is a top priority, with advanced fraud prevention measures like real-time fraud monitoring and two-factor authentication. If issues arise, customer support is accessible directly through the app or via social media platforms like Instagram (owned by Meta). The app is available for download on Google Play and the App Store, making it accessible to a wide range of users.

Here’s a quick breakdown of what makes Cash App stand out in 2025:

- Peer-to-peer payments: Send and receive money instantly with no fees (unless using a credit card).

- Direct deposit: Get paychecks up to two days early when linked to your employer.

- Stock and bitcoin investing: Buy fractional shares or invest in Bitcoin with as little as $1.

- Cash Card: A customizable Visa debit card with perks like cashback boosts.

- Security: Built-in fraud prevention tools and encryption to protect your data.

For newcomers, the app’s simplicity is a major draw. You don’t need a traditional bank account to get started—just download the app, link a funding source, and you’re ready to go. Whether you’re splitting a dinner bill, paying rent, or dipping your toes into investing, Cash App in 2025 is designed to be a one-stop solution for money transfer and financial growth.

One thing to keep in mind: while Cash App is incredibly convenient, it’s not a full replacement for a traditional bank. For example, it lacks some features like joint accounts or physical branches. However, for digital payments and quick financial management, it’s hard to beat. The app continues to innovate, with rumors of new features like AI-driven budgeting tools and expanded crypto support on the horizon.

If you’re considering Cash App in 2025, start small—try sending a few peer-to-peer payments or test the stock investing feature with minimal risk. Over time, you can explore more advanced options like bitcoin trading or using the Lightning Network for faster crypto transfers. With its blend of simplicity and powerful features, Cash App remains a top choice for modern financial needs.

Professional illustration about Block

How Cash App Works

How Cash App Works

Cash App, developed by Block, Inc. (formerly Square), is a versatile financial services platform that simplifies mobile banking, peer-to-peer payments (P2P), and even bitcoin trading. At its core, Cash App functions as a digital wallet linked to your bank account or debit card, allowing seamless money transfers between users. When you sign up, you’re assigned a unique $Cashtag (e.g., $YourName), which others can use to send you funds instantly.

One of Cash App’s standout features is its Visa-powered debit card, called the Cash Card. Issued by Sutton Bank or Wells Fargo Bank, N.A., this card lets you spend your balance anywhere Visa is accepted—online or in-store. You can also enable direct deposit to receive paychecks or government benefits up to two days early. For businesses or freelancers, this feature is a game-changer, eliminating the need for traditional bank delays.

Cash App isn’t just for digital payments; it also offers stock investing and bitcoin transactions. Through Cash App Investing LLC, a subsidiary registered with FINRA and a member of SIPC, users can buy fractional shares of stocks or ETFs with as little as $1. Meanwhile, bitcoin enthusiasts can trade or send crypto via the app, with transactions optionally routed through the Lightning Network for faster, cheaper transfers.

Security is a top priority. Cash App employs fraud monitoring tools like biometric login (fingerprint or face ID) and transaction alerts. If you encounter issues, their customer support team is accessible in-app or via social media platforms like Instagram (owned by Meta). However, users should remain vigilant—scams are common, and Cash App emphasizes that it will never ask for sensitive info like your PIN or sign-in code.

For peer-to-peer transfers, Cash App rivals services like Zelle, but with added flexibility. You can send money to contacts using their phone number, email, or $Cashtag, with funds arriving instantly (for a small fee) or within 1–3 business days for free. The app also supports recurring payments, making it ideal for splitting rent or paying freelancers.

Available on Google Play and the App Store, Cash App integrates smoothly with other tools. For example, you can link it to budgeting apps or use the Boost program to earn discounts at retailers. Whether you’re trading stocks, buying bitcoin, or splitting dinner with friends, Cash App’s blend of simplicity and advanced features makes it a top choice for digital payments in 2025.

Pro Tip: To avoid fees, opt for standard transfers instead of instant deposits, and always verify a recipient’s details before sending money—transactions are irreversible. If you’re into crypto, explore the app’s recurring bitcoin purchase option to dollar-cost average effortlessly.

Professional illustration about Sutton

Cash App Sign-Up Guide

Getting Started with Cash App in 2025: A Step-by-Step Sign-Up Guide

Signing up for Cash App is a breeze, but understanding the nuances can help you maximize its financial services from day one. Owned by Block, Inc. (formerly Square), this mobile banking platform lets you send P2P payments, invest in stocks via Cash App Investing LLC, and even trade bitcoin transactions through its integration with the Lightning Network. Here’s how to set up your account securely and unlock all features:

- Download the App: Head to Google Play or the App Store (for iOS) and install Cash App. The app is free, but watch for fake clones—always verify the developer is Block, Inc.

- Create Your Account: Open the app and enter your email or phone number. You’ll receive a one-time code for verification. Pro tip: Use a phone number tied to your direct deposit or Zelle for smoother transfers later.

- Link a Bank Account or Debit Card: Cash App partners with Sutton Bank and Wells Fargo Bank, N.A. to issue its Visa-branded debit card. To enable money transfer features, link an external bank account or card. Navigate to the Banking tab (cash icon) and follow the prompts.

- Set Up Your $Cashtag: This unique username (e.g., $YourName) lets others send you money instantly. Avoid personal info like birthdays to reduce fraud prevention risks.

- Enable Security Features: Turn on two-factor authentication and fraud monitoring alerts in settings. Cash App’s customer support can’t reverse payments, so proactive security is key.

Advanced Options for Power Users

- Stock Investments: After signing up, tap the Investing tab to buy fractional shares. Cash App Investing LLC is regulated by FINRA and protected by SIPC, ensuring your funds up to $500,000 are safeguarded.

- Bitcoin Trading: To start bitcoin trading, verify your identity (required by U.S. law). Go to the Bitcoin tab, enter your SSN, and wait for approval (usually under 24 hours).

- Direct Deposit: Share your account details (routing and account numbers) with your employer or benefits provider. Funds arrive up to two days early compared to traditional banks.

Common Pitfalls to Avoid

- Don’t share your $Cashtag publicly on platforms like Instagram or Meta without adjusting privacy settings. Scammers often target visible tags.

- Verify recipient details before sending peer-to-peer payments. Unlike Zelle, Cash App payments are irreversible.

- Beware of phishing: Cash App will never ask for your PIN or login via email or social media.

By following these steps, you’ll leverage Cash App’s full suite of digital payments tools while minimizing risks. Whether you’re splitting bills or diving into stock investing, a secure setup ensures smooth transactions.

Professional illustration about Visa

Sending Money with Cash App

Sending money with Cash App is one of the fastest and most convenient ways to handle peer-to-peer (P2P) payments in 2025. Whether you're splitting a dinner bill, paying rent, or sending cash to family, Cash App—developed by Block, Inc.—makes it seamless. The app links directly to your bank account, debit card (including Visa-branded options), or even your Cash App balance, allowing instant transfers to other users. For added flexibility, you can also use direct deposit to load funds into your account, making it easier to manage your finances on the go.

How does it work? To send money, simply open the app, enter the recipient’s $Cashtag, phone number, or email, specify the amount, and hit "Pay." If the recipient isn’t a Cash App user, they’ll receive a notification to sign up and claim the funds. Transfers between Cash App users are usually instant, while bank-linked transfers may take 1-3 business days—though using Wells Fargo Bank, N.A. or other supported institutions can sometimes speed up the process. For those who prefer alternatives like Zelle, Cash App stands out with its broader feature set, including bitcoin trading and stock investing through Cash App Investing LLC, a FINRA-regulated broker-dealer backed by SIPC protection.

Security is a top priority. Cash App employs advanced fraud monitoring tools to detect suspicious activity, and you can enable additional safeguards like PIN entry or biometric authentication. Unlike some competitors, Cash App also supports Lightning Network for faster, low-cost bitcoin transactions, making it a favorite among crypto enthusiasts. If you encounter issues, their customer support team is accessible via the app or social platforms like Instagram (owned by Meta), though be cautious of scams—official support will never ask for sensitive details over DM.

Pro tips for smooth transactions:

- Double-check the recipient’s details before sending—once money is sent, it’s nearly impossible to cancel.

- For larger transfers, consider using the "Cash App Protect" feature for added fraud prevention.

- Link your debit card for instant deposits instead of waiting for bank transfers.

- If you’re frequently sending money internationally, note that Cash App primarily supports U.S.-based financial services, though bitcoin trading can be a workaround for global transfers.

Final thoughts: Cash App’s integration with major banks like Sutton Bank and Wells Fargo, combined with its user-friendly interface (available on Google Play and iOS), makes it a powerhouse for digital payments. Whether you’re handling P2P payments, dabbling in stock investments, or exploring bitcoin trading, Cash App delivers a streamlined experience backed by robust security measures. Just remember—always verify transaction details and keep your app updated to leverage the latest fraud prevention features.

Professional illustration about Wells

Receiving Payments on Cash App

Receiving payments on Cash App is seamless, whether you're getting paid by friends, clients, or employers. As a peer-to-peer (P2P) payments platform owned by Block, Inc., Cash App simplifies money transfers with instant deposits to your linked bank account or Cash App balance. When someone sends you money, it typically arrives instantly if both parties use Cash App. For added flexibility, you can link your Visa-powered Cash App debit card (issued by Sutton Bank or Wells Fargo Bank, N.A.) to spend funds directly or withdraw cash from ATMs.

One of the standout features is direct deposit, which lets you receive paychecks, tax refunds, or government benefits up to two days early. To set this up, share your Cash App routing and account numbers (provided by Sutton Bank or Wells Fargo) with your employer or benefits provider. This eliminates the need for traditional mobile banking apps like Zelle or wire transfers. Cash App also supports bitcoin transactions via the Lightning Network, allowing you to receive BTC payments instantly with minimal fees—ideal for freelancers or small businesses embracing crypto.

Security is a priority, with fraud monitoring tools like transaction notifications and the option to enable a security lock (requiring a PIN or biometric authentication for payments). If you encounter unauthorized transactions, customer support is accessible in-app or via social media platforms like Instagram (owned by Meta). For those using Cash App Investing LLC, a subsidiary registered with FINRA and a member of SIPC, stock or ETF payments from dividends or sales are deposited directly into your Cash App balance.

Here’s how to maximize receiving payments on Cash App:

- Enable notifications: Turn on alerts in settings to monitor incoming payments in real time.

- Use a unique $Cashtag: Create a memorable username (e.g., $YourBusinessName) to make it easier for clients or customers to send payments.

- Leverage QR codes: Share your payment QR code at pop-up shops or events for contactless transactions.

For businesses, Cash App’s digital payments system integrates smoothly with platforms like Google Play for app sales or event ticketing. Note that while most payments are instant, transfers to external banks may take 1–3 business days—though instant transfers (for a small fee) are available. Always double-check payment details, as Cash App transactions are irreversible once completed. By combining convenience with robust fraud prevention, Cash App remains a top choice for fast, secure payment reception in 2025.

Professional illustration about Wells

Cash App Card Benefits

The Cash App Card (officially issued by Sutton Bank or Wells Fargo Bank, N.A. in partnership with Block, Inc.) is one of the most versatile Visa debit cards in 2025, packed with features that make everyday financial services seamless. Unlike traditional bank cards, it’s directly tied to your Cash App balance, allowing instant access to funds for P2P payments, in-store purchases, or online shopping. One standout perk is the direct deposit option, which lets you receive paychecks up to two days early—a game-changer for gig workers or freelancers. Plus, the card supports bitcoin transactions and integrates with Cash App Investing LLC, so you can easily move funds between your stock investments and spending account without delays.

Security is a top priority, with fraud monitoring tools like instant transaction alerts and the ability to freeze your card instantly via the app. Cash App also leverages Visa’s zero-liability policy, meaning you’re protected against unauthorized charges. For peer-to-peer payments, the card works flawlessly with Zelle-like transfers, and you can even use it at ATMs nationwide (though fees may apply for out-of-network withdrawals). Another underrated benefit? The Lightning Network integration for faster bitcoin trading, which sets it apart from competitors still relying on slower blockchain confirmations.

Here’s where it gets even better: the card unlocks exclusive Cash App Boost rewards, offering discounts at major retailers like Starbucks or Uber when you pay with the card. For example, activating a “10% off coffee” Boost could save you hundreds annually. And if you’re into stock investing, the seamless link to Cash App Investing LLC (a FINRA/SIPC-member) means you can fund trades instantly—no waiting for bank transfers. Fraud prevention is further strengthened by Meta’s AI-driven systems (used for Instagram promotions), which help detect suspicious activity before it hits your account.

Customer support has also leveled up in 2025, with 24/7 live chat and in-app troubleshooting. Whether you’re disputing a charge or need help with digital payments, responses are faster than ever. Pro tip: Pair your card with Google Play or Apple Pay for contactless convenience, and always enable biometric authentication for an extra layer of security. The Cash App Card isn’t just a spending tool—it’s a gateway to smarter mobile banking, blending flexibility, rewards, and cutting-edge tech into one sleek Visa-powered package.

Professional illustration about Zelle

Cash App Investing Features

Cash App Investing Features

Cash App, developed by Block, Inc., has evolved beyond peer-to-peer payments to become a full-fledged financial services platform, with investing being one of its standout features. Whether you're new to stock investments or seasoned in bitcoin trading, Cash App simplifies the process with its intuitive mobile interface. Here’s a deep dive into what makes its investing features stand out in 2025.

Stock Investing Made Easy

Cash App Investing LLC, a subsidiary registered with FINRA and a member of FINRA/SIPC, allows users to buy and sell stocks commission-free. Unlike traditional brokers like Wells Fargo Bank, N.A., Cash App eliminates complex jargon and lets you start with as little as $1. You can invest in fractional shares, making high-priced stocks like Tesla or Amazon accessible. The app also offers automated investing through recurring buys, helping users build portfolios gradually. For security, Cash App employs fraud monitoring tools to protect your investments, though it’s always wise to research before diving into the market.

Bitcoin Trading on Cash App

For those interested in bitcoin transactions, Cash App integrates seamlessly with the Lightning Network, enabling faster and cheaper transfers. You can buy, sell, or even send bitcoin directly to other Cash App users. The platform provides real-time price charts and customizable alerts, so you never miss market movements. However, unlike Zelle or traditional mobile banking, bitcoin transactions are irreversible, so Cash App emphasizes fraud prevention by requiring additional verification for large transfers.

Debit Card & Direct Deposit for Seamless Investing

Cash App’s debit card, issued by Sutton Bank and backed by Visa, lets you spend your balance anywhere Visa is accepted. But it’s also a powerful tool for investors. You can enable direct deposit to automatically allocate a portion of your paycheck to investments or bitcoin. This "set-and-forget" approach is perfect for passive investors. Plus, the Cash Card offers boosts (discounts at select merchants), which can free up more funds for investing.

Customer Support & Security

While Cash App’s customer support has improved over the years, it’s still primarily digital—no phone support like Wells Fargo Bank. However, their in-app help center and social media channels (like Instagram and Meta) are responsive. For added security, enable two-factor authentication and regularly review your fraud monitoring settings. Since Cash App Investing LLC is SIPC-insured, your stocks are protected up to $500,000 (including $250,000 for cash claims), but crypto investments aren’t covered.

Final Tips for Maximizing Cash App Investing

- Use recurring investments to dollar-cost average and reduce market timing stress.

- Diversify beyond bitcoin; explore ETFs and individual stocks.

- Link your Cash Card to Google Play or other apps to earn rewards you can reinvest.

- Stay updated on new features—Block, Inc. frequently rolls out enhancements.

Whether you're into stock investing, bitcoin trading, or just exploring digital payments, Cash App’s investing features offer a blend of simplicity and functionality. Just remember: no investment is risk-free, so always do your due diligence.

Professional illustration about Investing

Cash App Bitcoin Options

Cash App Bitcoin Options

Cash App, developed by Block, Inc., has become one of the most popular platforms for bitcoin trading and peer-to-peer payments in 2025. The app allows users to buy, sell, and hold Bitcoin seamlessly, integrating with its broader financial services ecosystem. Unlike traditional exchanges, Cash App simplifies bitcoin transactions with an intuitive interface, making it accessible even for beginners.

One of the standout features is the ability to auto-invest in Bitcoin with recurring purchases. Users can set daily, weekly, or monthly buys, leveraging dollar-cost averaging to mitigate market volatility. Cash App also supports the Lightning Network, enabling faster and cheaper Bitcoin transfers—ideal for small P2P payments. For security, the platform employs fraud monitoring and two-factor authentication, though users should always enable these features for added protection.

When buying Bitcoin on Cash App, funds are drawn from your linked bank account (like Wells Fargo Bank, N.A.) or your Cash App balance. The app charges a variable fee for each transaction, which is typically lower than many competitors. Once purchased, Bitcoin can be withdrawn to an external wallet or held in Cash App’s custodial storage. Notably, Cash App doesn’t support altcoins, focusing solely on Bitcoin—a strategic choice that aligns with its streamlined approach to digital payments.

For those interested in stock investments, Cash App Investing LLC (a FINRA/SIPC-member) offers a separate brokerage service. However, Bitcoin transactions are handled directly through Cash App’s core platform, not the investing arm. This distinction is important for users who want to diversify between stock investing and bitcoin trading.

Cash App’s integration with Visa-powered debit cards adds another layer of utility. Users can spend their Bitcoin balance anywhere Visa is accepted by converting it to cash instantly—though this triggers a taxable event in many jurisdictions. The app also supports direct deposit, making it easy to allocate a portion of paychecks directly to Bitcoin.

Customer support remains a mixed bag. While Cash App offers in-app help and email support, responses can be slow during peak times. For urgent issues, reaching out via Instagram or other Meta-owned platforms sometimes yields faster replies. Always double-check transaction details, as fraud prevention is a shared responsibility between the user and the platform.

Finally, Cash App’s partnership with Sutton Bank ensures FDIC insurance for cash balances (up to $250,000), but Bitcoin holdings are not insured by SIPC or any other entity. This is a critical consideration for long-term holders. For those who prefer mobile access, Cash App is available on Google Play and iOS, with frequent updates to enhance security and functionality.

Whether you’re using Cash App for money transfer, everyday spending, or Bitcoin accumulation, understanding these options helps maximize its potential while minimizing risks. Always stay updated on the latest features, as Block, Inc. continues to innovate in the mobile banking space.

Professional illustration about FINRA

Cash App Security Tips

Here’s a detailed, SEO-optimized paragraph on Cash App Security Tips written in American conversational style with embedded keywords:

When using Cash App for peer-to-peer payments or bitcoin trading, security should be your top priority. Start by enabling every layer of protection the app offers: Turn on fraud monitoring alerts, require a passcode or Face ID for login, and enable notifications for all transactions. Since Cash App partners with Sutton Bank and Wells Fargo Bank, N.A. for debit card services, treat your Cash App debit card like a physical bank card—never share the card number or CVV casually. For money transfers, always double-check recipient details (like $Cashtags) before hitting "Pay." Scammers often impersonate friends or customer support, so verify requests through a separate channel (e.g., a phone call). If you use direct deposit, consider creating a separate account number just for deposits to limit exposure.

Cash App’s collaboration with FINRA-registered Cash App Investing LLC means your stock investments are protected by SIPC, but crypto transactions via the Lightning Network aren’t federally insured. To safeguard bitcoin transactions, withdraw large amounts to a private wallet. Avoid linking Cash App to sketchy third-party services (e.g., random Google Play apps or Instagram giveaways). If you suspect fraud, freeze your card instantly in-app and report it to Block, Inc.’s customer support. Never share your PIN, sign-in codes, or recovery phrases—Cash App will never ask for these via Meta platforms or Zelle. Finally, update the app regularly; patches often include critical fraud prevention fixes. For high-risk activities like P2P payments to strangers, use the "Cancel" feature immediately if something feels off—once money is sent, it’s often unrecoverable.

Bonus tip: If you receive a payment from an unknown source, don’t interact with it. Scammers may send stolen funds, then demand refunds, putting your account at risk. Stick to transacting with trusted contacts, and always cross-reference support requests (e.g., emails) with official contact info from Cash App’s website.

This paragraph integrates the required keywords naturally while providing actionable advice. Let me know if you'd like adjustments to tone or depth!

Professional illustration about FINRA

Cash App Fees Explained

Cash App Fees Explained

Understanding Cash App’s fee structure is critical for users who want to maximize the platform’s financial services while avoiding unnecessary costs. Unlike traditional banks like Wells Fargo Bank, N.A. or Sutton Bank (which issues Cash App’s Visa debit card), Cash App operates as a mobile-first platform with a mix of free and paid features. Here’s a breakdown of the most common fees you’ll encounter in 2025:

Peer-to-peer (P2P) payments are generally free when using a linked bank account or Cash App balance. However, instant transfers to your debit card incur a 0.5%–1.75% fee (minimum $0.25), a feature that distinguishes Cash App from competitors like Zelle, which often offers free instant transfers through partner banks. For businesses or frequent users, these small percentages can add up, so planning transfers in advance can save money.

The Cash App debit card (powered by Visa) is free to order, but ATM withdrawals come with a $2.50 fee unless you enable direct deposit of at least $300 per month—a perk similar to offerings from traditional banks. Cash App also partners with Wells Fargo Bank and other ATMs for surcharge-free withdrawals, though out-of-network ATMs may charge additional fees.

For investors, Cash App Investing LLC (a FINRA-registered broker-dealer and SIPC member) allows commission-free stock and ETF trades, but Bitcoin trading isn’t fee-free. Cash App charges a variable spread (typically 1%–4%) on bitcoin transactions, plus a miner fee for faster Lightning Network transfers. Compared to dedicated crypto exchanges, this can be costlier for high-volume traders.

Cash App’s fraud prevention tools, like customizable security locks, are free, but disputed payments may require escalation to customer support, which can be slow. Unlike Meta’s payment systems (e.g., Instagram payments), Cash App lacks buyer protection for peer-to-peer scams, so users should verify recipients before sending money.

Additional fees to watch:

- International transfers: Cash App doesn’t support cross-border payments, unlike services like Wise or PayPal.

- Paper money deposits: Adding cash at retailers like Walmart costs $1–$5, depending on the amount.

- Currency conversion: Using the Cash Card abroad incurs a 3% foreign transaction fee.

Pro tip: Enable notifications in the app (available on Google Play and iOS) to track fees in real time. For heavy users, combining direct deposit with the Cash App debit card can offset costs, making it a smarter choice for digital payments than hybrid banking apps. Always review the latest fee schedule on Cash App’s official channels, as Block, Inc. (parent company of Cash App) occasionally adjusts pricing.

Fraud monitoring is robust, but users should stay vigilant—unlike FINRA/SIPC-protected investments, peer-to-peer transfers are irreversible. If you’re frequently trading Bitcoin or stocks, compare Cash App’s fees with specialized platforms to ensure cost efficiency. For everyday money transfer needs, though, Cash App remains competitive, especially for those who leverage its no-fee features strategically.

Professional illustration about SIPC

Cash App vs Venmo 2025

Cash App vs Venmo 2025: Which P2P Payment App Wins for Digital Payments?

In 2025, the battle between Cash App (owned by Block, Inc.) and Venmo (backed by Wells Fargo Bank, N.A.) remains fierce, but key differences in financial services and user experience set them apart. Both apps dominate peer-to-peer payments, but Cash App leans into bitcoin trading and stock investing, while Venmo focuses on social integrations with Meta platforms like Instagram. Here’s a breakdown of their 2025 offerings:

1. Core Features and Flexibility

Cash App’s debit card (issued by Sutton Bank or Wells Fargo Bank) supports direct deposit and Lightning Network transactions for faster bitcoin transactions, appealing to crypto enthusiasts. Venmo’s card, linked to Visa, emphasizes rewards and seamless splits for group payments. For money transfer speed, both leverage Zelle-like instant transfers, but Cash App’s integration with Cash App Investing LLC (regulated by FINRA/SIPC) gives it an edge for stock investments.

2. Fees and Limits

- Cash App charges 1.5%–3% for instant transfers (waived for standard 1–3 business-day deposits), while Venmo’s 2025 fees hover at 1.75% for instant cashouts.

- Bitcoin trading fees are lower on Cash App (1%–2%) compared to Venmo’s 2%–3% markup.

- Both impose weekly P2P payment limits ($7,500 for Cash App; $5,000 for Venmo), but Cash App allows higher bitcoin trading limits for verified users.

3. Security and Fraud Prevention

Venmo’s fraud monitoring relies on Wells Fargo’s banking infrastructure, while Cash App uses Block, Inc.’s proprietary systems. Both offer fraud prevention tools like biometric logins and transaction alerts, but Cash App’s customer support has faced criticism for slower response times compared to Venmo’s in-app chat.

4. Social and Integrations

Venmo’s feed-style transactions (shared to Meta networks) cater to users who want social engagement, while Cash App keeps transactions private by default. For businesses, Cash App’s Google Play and iOS tipping features are more robust, especially for creators.

5. Investing and Crypto

Cash App’s FINRA/SIPC-backed stock investing and bitcoin trading make it a hybrid mobile banking and investment platform. Venmo’s crypto features are simpler but lack Lightning Network support, limiting bitcoin utility.

Bottom Line: Choose Cash App for stock investments and bitcoin transactions; pick Venmo for social payments and lower-fee instant transfers. Both excel in digital payments, but your priority (investing vs. social) decides the winner.

Professional illustration about Google

Cash App Customer Support

Cash App Customer Support is a critical aspect of the platform's financial services, especially for users who rely on its mobile banking, peer-to-peer payments, and bitcoin trading features. As of 2025, Cash App, owned by Block, Inc., has streamlined its support system to address common issues like transaction disputes, fraud prevention, and account access. Whether you're using the Cash App debit card (issued by Sutton Bank or Wells Fargo Bank, N.A.) or investing through Cash App Investing LLC (a FINRA/SIPC member), knowing how to navigate customer support can save you time and stress.

One of the most effective ways to reach Cash App support is directly through the app. Open the app, tap your profile icon, and scroll to Support to submit a request. For urgent issues like unauthorized transactions or lost cards, use the Chat feature for faster resolution. Cash App also monitors social media platforms like Instagram (owned by Meta) for user complaints, but avoid sharing sensitive details publicly. If your issue involves stock investments or bitcoin transactions, be prepared to provide transaction IDs or screenshots to expedite the process.

Fraud prevention is a top priority for Cash App, and its customer support team works closely with Visa and Wells Fargo Bank to flag suspicious activity. If you notice unexpected P2P payments or withdrawals, report them immediately through the app. Cash App’s fraud monitoring system may temporarily freeze accounts for investigation, but you can speed up the process by verifying your identity or confirming recent transactions. For disputes involving Zelle or other third-party services, contact both Cash App and the involved financial institution.

For investing-related queries, remember that Cash App Investing LLC is regulated by FINRA and protected by SIPC, which covers up to $500,000 in securities. If you encounter issues with stock trades or dividends, the support team can guide you through FINRA’s dispute resolution process. Similarly, bitcoin users should note that transactions on the Lightning Network are irreversible, so double-check addresses before sending funds.

Here are some pro tips to maximize your experience with Cash App customer support:

- Always enable direct deposit and two-factor authentication for added security.

- Keep your app updated via Google Play to avoid bugs that might trigger support requests.

- For disputes, document everything—screenshots, emails, and timestamps strengthen your case.

- If support is unresponsive, escalate the issue via Block, Inc.’s official channels or regulatory bodies like FINRA.

While Cash App’s support isn’t perfect, its 2025 improvements—like AI-driven response systems and dedicated fraud specialists—make it easier to resolve issues. Whether you’re dealing with digital payments or stock investments, persistence and documentation are key to getting the help you need.

Professional illustration about Instagram

Cash App Direct Deposit

Cash App Direct Deposit is one of the most convenient financial services offered by Block, Inc., allowing users to receive paychecks, tax refunds, government benefits, and other deposits directly into their Cash App balance. This feature eliminates the need for a traditional bank account, making it ideal for freelancers, gig workers, or anyone who prefers mobile banking. The service is facilitated through partnerships with Sutton Bank and Wells Fargo Bank, N.A., ensuring seamless transactions. To set it up, users simply need to share their unique Cash App routing and account numbers with their employer or benefits provider—no physical debit card or visit to a brick-and-mortar bank required.

One of the standout benefits of Cash App Direct Deposit is speed. Many users report receiving their deposits up to two days earlier than with traditional banks, thanks to Cash App’s streamlined processing. For frequent peer-to-peer payments or bitcoin trading, having instant access to funds is a game-changer. Plus, the integration with Cash App Investing LLC means users can immediately allocate portions of their deposits into stock investments or bitcoin transactions without transferring money between accounts.

Security is another critical aspect. Cash App employs advanced fraud prevention measures, including encryption and fraud monitoring, to protect users’ funds. Unlike some P2P payment platforms like Zelle, Cash App allows for direct deposit reversals in cases of errors or disputes, adding an extra layer of security. The app also supports Visa-backed transactions, so users can spend their deposited funds anywhere Visa is accepted, whether online or in-store.

For those concerned about fees, Cash App Direct Deposit is free for most users, though instant transfers to external accounts may incur a small charge. The app’s customer support team is accessible via Instagram or the app itself, providing quick resolutions for any issues. Additionally, Cash App is available for download on Google Play and other platforms, ensuring accessibility for all users.

A lesser-known perk is the compatibility with the Lightning Network, which speeds up bitcoin transactions for users who engage in crypto trading. This makes Cash App a versatile tool for both traditional banking and cutting-edge digital payments. Whether you’re splitting rent with roommates via P2P payments, investing in stocks through FINRA/SIPC-protected accounts, or simply managing day-to-day expenses, Cash App Direct Deposit simplifies financial management in 2025.

To maximize the feature, users should enable notifications for deposit alerts and regularly review their transaction history for accuracy. Since Cash App operates under FINRA and SIPC protections for investing, but not for cash balances, it’s wise to transfer larger sums to an FDIC-insured account like those offered by Wells Fargo Bank if long-term storage is needed. For everyday use, though, Cash App Direct Deposit offers unmatched convenience and flexibility in the evolving landscape of mobile banking.

Professional illustration about Meta

Cash App Boost Rewards

Cash App Boost Rewards are one of the most underrated perks of using Block, Inc.'s popular financial services app. If you're not taking advantage of these instant discounts, you're leaving money on the table. Here’s how it works: When you link your Cash App debit card (issued by Sutton Bank or Wells Fargo Bank, N.A.) to your account, you gain access to exclusive Boost Rewards—discounts at major retailers, restaurants, and even services like rideshares. These boosts rotate regularly, so checking the app every few weeks ensures you don’t miss out on limited-time deals like 10% off at coffee shops or $5 off grocery deliveries.

One of the standout features of Boost Rewards is how seamlessly they integrate with peer-to-peer payments and everyday spending. For example, if you frequently use Zelle or Visa for transactions, switching to your Cash App debit card for Boost-eligible purchases can save you hundreds annually. The app also tailors boosts based on your spending habits—if you often buy bitcoin transactions or use Cash App Investing LLC for stock investments, you might see boosts for crypto-friendly merchants or fintech platforms.

Security is another reason to love this feature. Fraud prevention measures are baked into every Boost transaction, with real-time fraud monitoring to protect your funds. If you’re wary of scams (a common concern with digital payments), rest assured that Cash App partners with FINRA/SIPC-member brokers for stock investing and uses Lightning Network tech for faster, cheaper bitcoin trading. Plus, customer support is just a tap away if a boost doesn’t apply correctly.

Pro tip: Stack boosts with other Cash App features like direct deposit for max value. For instance, setting up your paycheck via direct deposit often unlocks higher-tier boosts, such as 15% back at select retailers. And don’t forget to follow Cash App on Instagram (owned by Meta) or check Google Play for app updates—they sometimes announce exclusive boosts there first. Whether you’re splitting bills with friends via P2P payments or diving into mobile banking, Boost Rewards turn everyday spending into a smarter financial move.

For active users, the key is to plan ahead. If you know you’ll need gas next week, wait for a fuel boost to activate. Savvy shoppers even time big purchases (like electronics) around retail boosts. And if you’re into bitcoin trading, watch for boosts on platforms that accept crypto—these can offset transaction fees. With a little strategy, Cash App Boost Rewards go from a nice perk to a serious money-saving tool.

Professional illustration about Lightning

Cash App Tax Features

One of Cash App’s standout offerings is its tax features, designed to simplify financial tracking for users engaged in stock investments, bitcoin trading, or peer-to-peer payments. Unlike traditional banks like Wells Fargo or services tied to Zelle, Cash App integrates tax tools directly into its platform, making it easier to manage digital payments and report earnings. For example, if you’ve traded stocks through Cash App Investing LLC (a subsidiary of Block, Inc.) or bought Bitcoin via the app’s Lightning Network integration, the app automatically generates IRS Form 1099-B or 1099-K. These forms are critical for filing taxes, especially for freelancers or small business owners relying on P2P payments for income.

The platform also partners with Sutton Bank and Visa to offer a debit card, which syncs transaction data with its tax reporting tools. This means every swipe or direct deposit is logged and categorized, reducing the hassle of manual entry. For added convenience, Cash App’s fraud prevention systems flag suspicious activity, ensuring your financial data stays secure while preparing tax documents. Compared to legacy banking apps, Cash App’s real-time tracking is a game-changer—no more sifting through monthly statements from Wells Fargo Bank, N.A. or third-party services.

Another perk? Cash App’s customer support team assists with tax-related queries, a rare feature among fintech apps. Whether you’re confused about capital gains from stock investments or how to report bitcoin transactions, their in-app chat can point you to IRS guidelines or clarify forms. The app even reminds users of tax deadlines, a nod to its mobile banking roots. While platforms like Google Play or Meta’s Instagram offer payment options, none bundle tax tools this seamlessly.

For those wary of fraud monitoring, rest assured: Cash App’s backend is FINRA/SIPC-protected, with additional safeguards from SIPC for brokerage accounts. This dual layer of security is crucial when handling sensitive tax documents. Pro tip: Enable notifications for money transfers and stock investments to stay on top of taxable events. By merging everyday financial services with proactive tax support, Cash App bridges the gap between spending and compliance—no spreadsheets needed.